Are Billing and Invoicing the Same Thing?

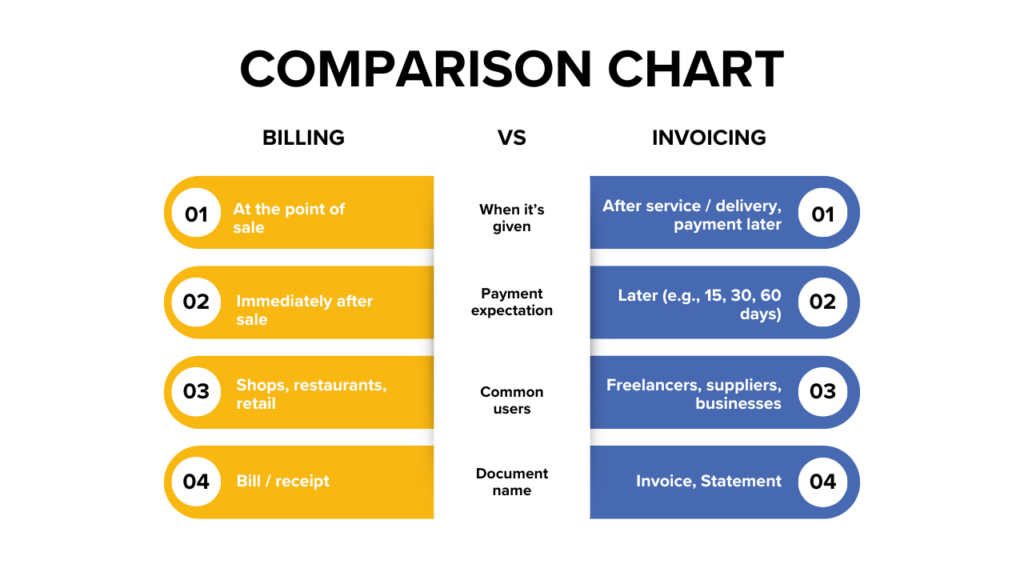

Kenfra Research - Bavithra2026-01-27T17:15:06+05:30If you’re running a small business in Tamil Nadu, India, working as a freelancer, or just learning about basic finance, you’ve likely heard the terms billing and invoicing. Most people use them interchangeably, but are they the same thing? The short answer: No — billing and invoicing are related but not exactly the same. Let’s break it down in plain, simple words.

This guide will help you understand the difference between billing and invoicing. You will learn what billing is, what invoicing is, and the main differences between them. We will also share practical examples from Indian businesses to make it easy to understand. By the end of this blog, you’ll never confuse billing with invoicing again!

What is a Billing?

Billing is the process of generating a bill to request immediate payment from a customer for goods or services. It is commonly used in retail stores, restaurants, grocery shops, salons, and other everyday businesses. A bill is a document given to the customer at the point of sale. It shows the total amount payable for the goods or services purchased, including taxes (like GST). Bills serve as proof of payment and help both the customer and the business maintain records of transactions.

Key points about a bill:

- It is issued after or at the time of payment.

- It includes items purchased, prices, taxes (GST), and total payable.

- It serves as proof of payment.

Example: If you buy groceries in Tirunelveli, the cashier hands you a bill showing ₹500 for the items purchased, including GST. That bill confirms your payment.

What is an Invoice?

Invoicing is the process of creating a formal document called an invoice, which requests payment for goods or services provided. Unlike a bill, an invoice is usually issued when payment is not immediate and includes a payment due date. Invoices are commonly used in B2B transactions, freelance work, service industries, and online businesses. They serve as a legal record of the transaction and help both the business and the customer track pending payments.

Key points about an invoice:

- It is issued before or after delivering goods/services but usually includes a payment due date.

- It contains details like work done, service charges, GST, and payment terms.

- It serves as a legal document and proof of a pending payment.

Example: A freelancer in Coimbatore designing a logo for a café sends an invoice requesting payment within 15 days. The invoice will have a unique invoice number and GST details.

Real Business Examples in India

Example 1: Grocery Store Billing

Ramu runs a grocery shop in Salem, Tamil Nadu. When a customer buys rice and lentils, he gives a bill. The customer pays immediately. No due date, no waiting.

This is billing.

Example 2: Freelance Graphic Designer

Priya is a graphic designer in Erode. She completes a brochure design for a client. She sends an invoice with payment terms: “Pay within 7 days.”

This is invoicing.

Example 3: Manufacturer and Retailer

A small textile manufacturer in Tiruppur supplies cloth to a retailer. The manufacturer issues an invoice because the retailer will pay later, usually after 30 days.

Again, this is invoicing, not billing.

Billing and invoicing both show money owed, but the timing is different.

Why Businesses Should Know the Difference Between Billing and Invoicing?

1. Better Cash Flow

Understanding when to issue a bill or an invoice helps businesses manage money effectively. Bills bring in immediate payments, while invoices track delayed payments. This ensures the business always has enough cash for daily operations. It also helps avoid financial shortages or surprises. Proper payment management keeps the business stable and reliable.

2. GST Compliance

Invoices must follow GST rules in India, including invoice number, date, and GST details. Correct invoicing ensures the business stays legally compliant. It helps calculate input and output GST accurately. Following GST rules avoids penalties or fines from authorities. Proper compliance also builds trust with clients and tax officials.

3. Professional Image

Using proper bills and invoices shows clients that the business is organized and professional. A clear and detailed invoice improves client confidence and trust. It ensures clients understand payment terms clearly. Timely and accurate billing encourages faster payments. A professional image strengthens the business reputation and relationships.

4. Easy Accounting and Tax Filing

Bills and invoices help track all income and expenses accurately. They simplify bookkeeping and financial record keeping. Using them properly makes GST filing and income tax returns easier. Accurate records reduce errors and complications during audits. Good documentation ensures the business can make informed financial decisions.

FAQ: Billing and Invoicing – What You Need to Know

1. Is billing and invoicing same or different?

Billing and invoicing are not the same, though they are related. Billing refers to the entire process of charging for services, while invoicing is just a part of that process. Invoicing is the document you send to request payment, and billing involves the larger charge and follow-up process.

2. Can billing happen without an invoice?

Yes, billing can happen without an invoice. Sometimes, businesses or service providers may just tell you how much you owe via email or verbally. However, professional services like PhD assistance in Marthandam or any PhD research consultancy in India typically use invoices for clarity, record-keeping, and transparency.

3. What is the difference between an invoice and a receipt?

An invoice is a request for payment, typically showing details like the amount owed and the due date. A receipt is proof that you have already paid the amount. After you make a payment, the service provider will give you a receipt showing that you’ve paid your bill.

4. Can small businesses use billing without invoicing?

Yes, small businesses can sometimes just bill you informally without sending an invoice, especially if they’re just starting. However, for long-term contracts or formal services (like PhD assistance near me), invoicing is highly recommended for better tracking and professionalism.

5. How does billing work for PhD research companies in India?

Billing for PhD research companies in India is usually done in stages. Each phase—like the initial consultation, literature review, or final report—is billed separately, with an invoice sent for each milestone. This keeps costs clear and payments organized.

Final Words

Understanding the difference between billing and invoicing is essential for any business in Tamil Nadu, India, and across the country. Whether you run a tea shop in Tiruchi, a consultancy in Chennai, or a freelance service, knowing when to bill and when to invoice will help you manage money, improve cash flow, and stay compliant with GST rules. A reliable tool like Kenfra Billpad can simplify your billing and invoicing process, making it easier to stay on top of your financial records.

Leave a Reply