GST Made Simple: Effortless Billing Tips for 2026

Kenfra Research - Bavithra2025-12-19T17:26:50+05:30GST billing can feel confusing for many business owners, especially as rules keep evolving every year. As we move into 2026, understanding GST billing tips for 2026 is more important than ever for small businesses, freelancers, and growing enterprises. A small billing mistake can lead to penalties, delayed payments, or compliance issues. The good news is that GST billing does not have to be complicated if you follow the right approach and use the correct tools.

With updated compliance rules, better tools, and clear formats, creating a correct GST bill is now more about accuracy than effort. In this blog, we’ll explain GST billing in simple words, share effortless billing tips, and help you stay compliant without stress.

What is GST Billing?

GST billing means creating an invoice that follows Goods and Services Tax rules in India. A GST bill is a legal document that records the sale of goods or services and shows how much tax is charged.

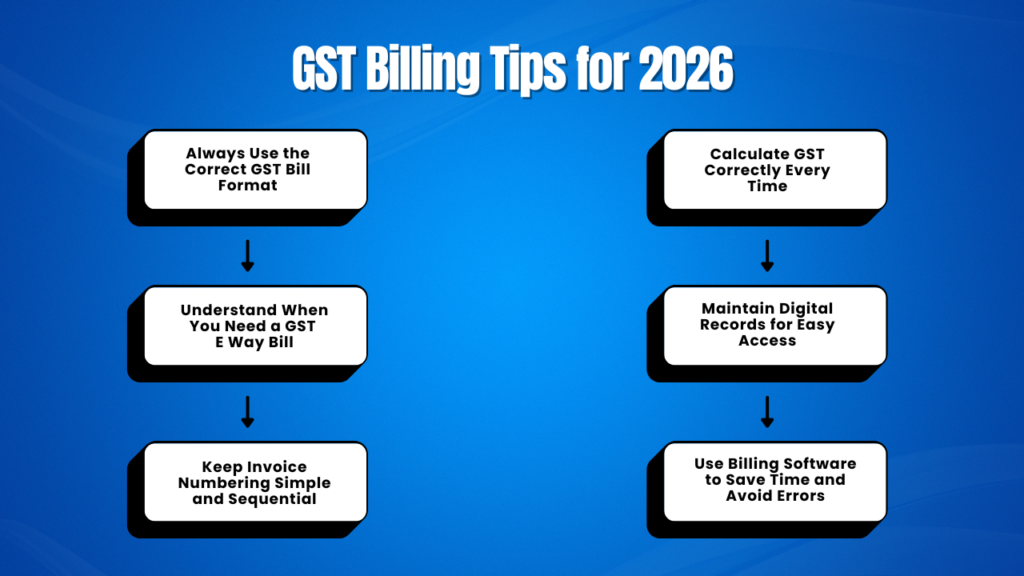

Essential GST Billing Tips for 2026 to Avoid Errors and Stay Compliant

1. Always Use the Correct GST Bill Format

One of the most common mistakes businesses make is using an incorrect gst bill format. Every GST invoice must contain specific details such as supplier name, GSTIN, invoice number, date, customer details, HSN or SAC code, taxable value, tax rate, and tax amount.

In 2026, automated return filing systems rely on invoice data accuracy. If your gst bill is missing key information, it can cause mismatches during return filing. Customers may also reject invoices if they cannot claim input tax credit due to errors. Always double-check your invoice structure and ensure it follows the latest GST rules.

2. Understand When You Need a GST E Way Bill

Transporting goods without proper documentation can result in penalties. A gst e way bill is mandatory when the value of goods exceeds the prescribed limit and goods are moved from one place to another. Many businesses forget this requirement or generate it incorrectly.

You should clearly understand when an eway bill gst is required, how to generate it, and how long it remains valid. In 2026, enforcement has become stricter, and transporters are frequently checked. Linking your invoice with the correct e-way bill details ensures smooth movement of goods and avoids unnecessary delays.

3. Keep Invoice Numbering Simple and Sequential

Invoice numbering may sound basic, but it plays a crucial role in GST compliance. Each gst bill must have a unique and sequential invoice number. Skipping numbers or using random formats can raise red flags during audits.

In 2026, digital scrutiny has increased, making proper numbering even more important. Use a consistent series for each financial year and avoid manual changes. This makes reconciliation easier and helps when filing returns or responding to queries from tax authorities.

4. Calculate GST Correctly Every Time

Incorrect tax calculation is another major issue businesses face. Applying the wrong tax rate or calculating GST on the wrong value can lead to underpayment or overpayment of tax. This becomes a serious issue when filing returns.

Make sure you apply CGST, SGST, or IGST correctly based on the place of supply. The gst bill should clearly show tax breakup so customers can understand what they are paying. In 2026, even small calculation mistakes can affect input tax credit matching, so accuracy is key.

5. Maintain Digital Records for Easy Access

Gone are the days of paper-only billing. In 2026, digital record-keeping is not just convenient but necessary. All gst bill records should be stored securely in digital format for quick access during audits or return filing.

Maintaining organized records helps you track sales, monitor tax liability, and resolve disputes faster. Digital records also make it easier to integrate billing data with return filing systems and reduce manual errors.

6. Use Billing Software to Save Time and Avoid Errors

Manual billing increases the chances of mistakes, especially as transaction volumes grow. Billing software helps automate invoice creation, tax calculation, and compliance tasks. It also ensures the correct gst bill format is followed every time.

Good billing software can generate invoices, manage e-way bill details, track payments, and store data securely. In 2026, using software is no longer optional for growing businesses; it is a practical necessity to stay compliant and efficient.

Common GST Billing Mistakes to Avoid

Many businesses still issue invoices without proper GSTIN details or forget to update customer information. Others delay invoice generation, which affects return filing timelines. Some also ignore eway bill gst requirements during goods movement, leading to penalties.

Avoid these mistakes by reviewing your billing process regularly and staying updated with GST rules. Small improvements can make a big difference in compliance and peace of mind.

FAQs on GST Billing in 2026

1. What is the correct gst bill format for 2026?

The gst bill format must include supplier and buyer details, GSTIN, invoice number, date, HSN or SAC code, taxable value, tax rate, and tax amount. The structure remains similar, but accuracy is more important in 2026.

2. Is gst e way bill mandatory for all goods movement?

A gst e way bill is required when the value of goods exceeds the prescribed limit and goods are transported. Certain exemptions apply, but most inter-state and high-value movements require it.

3. How long should GST invoices be stored?

GST invoices should be stored for at least six years from the due date of the annual return for that year.

4. What happens if my gst bill has errors?

Errors can lead to mismatches in returns, rejection of input tax credit, and possible notices from tax authorities. Correcting invoices quickly is important.

Conclusion

GST billing does not have to be stressful if you follow the right practices. By using the correct gst bill format, understanding gst e way bill rules, maintaining proper records, and calculating tax accurately, you can stay compliant and confident in 2026. The right billing approach saves time, reduces errors, and helps your business grow smoothly.

If you are looking for an easy way to manage GST billing, Kenfra BillPad is a billing software that helps you create compliant invoices and manage your billing efficiently. It also offers a free trial, making it a smart option for businesses that want hassle-free GST billing in 2026.

Leave a Reply