How AI-Powered Billing Systems Are Redefining Accuracy in Invoicing?

Kenfra Research - Bavithra2025-11-07T09:35:54+05:30In today’s fast-moving business world, accurate billing and invoicing are more important than ever. Small errors in invoices can lead to big financial losses, unhappy customers, and wasted time. This is where AI-powered billing systems are changing the game.

These systems use artificial intelligence to make invoicing faster, smarter, and more accurate than traditional manual methods. Let’s explore what AI billing systems are, their types, and how they’re redefining accuracy in invoicing.

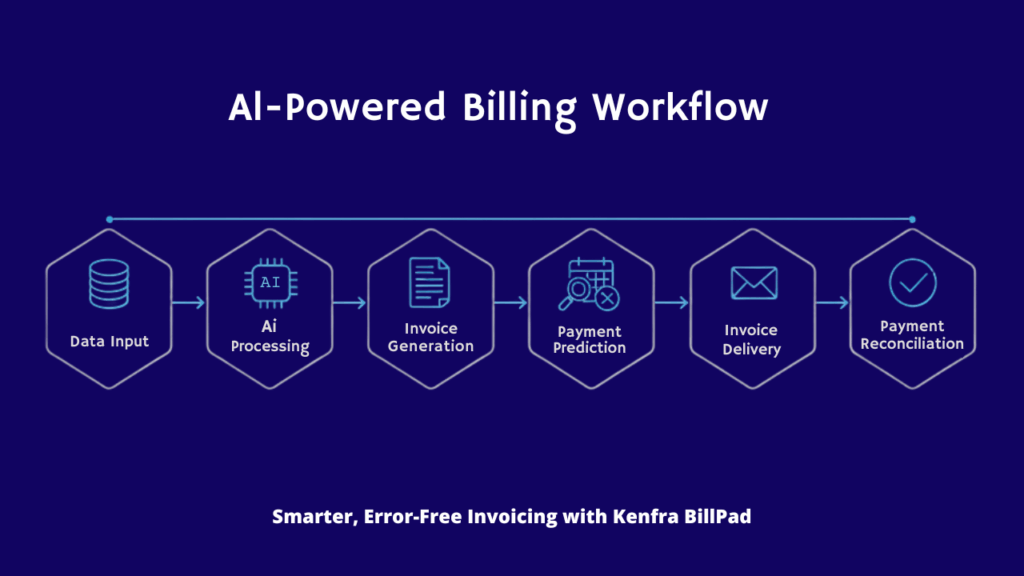

What Is an AI-Powered Billing System?

An AI-powered billing system is a digital platform that uses artificial intelligence and machine learning to automate and improve the process of creating, sending, and managing invoices.

Unlike traditional billing software that relies on manual input, AI systems can:

- Read data from different sources (like purchase orders, emails, or spreadsheets)

- Detect and correct human errors automatically

- Predict payment dates and customer behavior

- Send reminders and follow-ups automatically

In simple terms, AI billing systems help businesses save time, reduce mistakes, and improve cash flow by making invoicing smarter.

Why Traditional Invoicing Often Fails?

Before AI came into the picture, most companies used manual or semi-automated billing systems. This often caused:

- Human errors: Typos, wrong totals, or incorrect tax amounts

- Delayed payments: Late invoice sending or lost invoices

- Data duplication: Re-entering the same customer or product details multiple times

- Poor visibility: Hard to track who has paid and who hasn’t

These small issues can snowball into big challenges for finance teams. AI billing systems were created to solve exactly these pain points.

Types of AI-Powered Billing Systems

AI billing solutions come in several forms depending on the industry, business size, and technology used. Below are some of the most common types:

a. Automated Invoice Generation Systems

These systems create invoices automatically from sales data, order entries, or time-tracking software.

For example, when a project is completed, the system can instantly generate and send an invoice — no human input needed.

b. Smart Invoice Scanning and Data Extraction

These systems use Optical Character Recognition (OCR) and AI to scan paper invoices or PDF bills, extract relevant data, and store it digitally.

This is very useful for companies still receiving physical invoices from vendors.

c. Predictive Billing Systems

Predictive systems use machine learning to forecast future payments, detect patterns, and highlight risks such as potential delays.

They can also suggest the best time to send invoices to ensure faster payments.

d. Subscription and Recurring Billing AI Systems

Used by SaaS, telecom, or membership-based businesses, these tools manage recurring payments automatically — sending monthly invoices, applying discounts, and updating plans without manual work.

e. AI-Powered Payment Reconciliation Systems

These tools match payments received with the correct invoices. If there’s a mismatch, they alert the finance team instantly, helping avoid payment confusion.

How AI Is Redefining Accuracy in Invoicing?

Now that we understand the basics, let’s dive into how AI billing systems actually improve accuracy and redefine invoicing.

a. Eliminating Human Error

AI-powered systems reduce the need for manual data entry, which is often the main source of mistakes.

When invoices are generated automatically using verified data sources (like CRM or ERP software), the chances of typos or wrong amounts drop dramatically.

For example, if a company has hundreds of transactions daily, an AI system can pull correct figures directly from sales records — ensuring every invoice is precise and consistent.

b. Real-Time Data Validation

AI tools can validate information instantly before an invoice is sent out.

If a customer’s tax ID is missing, a price is mismatched, or a payment term seems off, the system flags it right away.

This proactive approach means fewer corrections later and less back-and-forth between finance teams and clients.

c. Smart Fraud Detection

AI billing systems also help in detecting invoice fraud — a growing problem for many businesses.

Using machine learning, the system learns what a normal invoice looks like and can detect suspicious patterns such as duplicate invoices, wrong bank details, or sudden changes in payment destinations.

This improves trust and financial security for both businesses and their customers.

d. Faster Invoice Processing

AI reduces the time it takes to create, approve, and send invoices.

What once took hours or even days can now be done in minutes. This faster process not only improves cash flow but also minimizes the chances of delay-related errors.

For instance, automated invoice approval workflows ensure that invoices move to the right person without getting stuck in email chains.

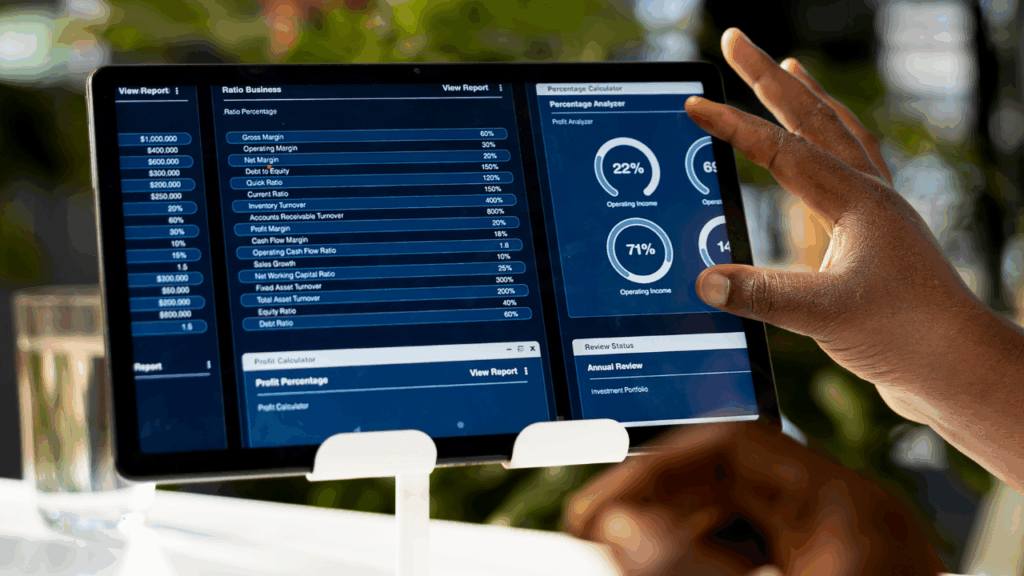

e. Predictive Insights for Better Accuracy

AI doesn’t just automate — it learns from past data.

It can analyze trends to predict when a customer is likely to pay, how often they delay, or whether certain invoice formats lead to quicker payments.

These insights help finance teams make smarter decisions and plan better for future cash management.

f. Automatic Currency and Tax Adjustments

For global businesses, managing multiple currencies and tax rules can be tricky.

AI billing systems can automatically calculate exchange rates, tax percentages, and regional compliance — ensuring each invoice meets local laws accurately.

This helps prevent costly compliance errors and supports smooth cross-border billing.

g. Seamless Integration and Accuracy Across Platforms

AI billing tools can connect easily with other business systems such as:

- Accounting software

- ERP systems

- CRM platforms

Because of these integrations, data flows smoothly across departments — reducing duplicate entries and making sure all information is consistent everywhere.

Real-World Impact: Accuracy That Drives Trust

When businesses consistently send accurate invoices, customers notice.

AI-driven billing builds trust by showing professionalism and reliability. It reduces disputes and misunderstandings, helping strengthen client relationships.

A company that used to spend hours correcting invoice errors can now focus on growth, customer service, and strategy — not paperwork.

For example:

- A marketing agency using AI billing software can generate accurate client bills based on project hours automatically.

- A SaaS startup can automate monthly subscriptions and ensure zero missed payments.

- A manufacturing firm can reconcile supplier invoices faster and spot pricing discrepancies immediately.

The Future of AI in Invoicing

The evolution of AI billing doesn’t stop at automation. Future systems will bring even more intelligence, such as:

- Voice-activated billing commands (“Generate invoice for Client A”)

- Chatbot invoice assistance to answer customer billing questions instantly

- Blockchain-based smart invoicing for transparent and tamper-proof transactions

- Self-correcting invoices that automatically update based on contract changes

The ultimate goal? Zero-error, zero-delay billing that runs smoothly in the background.

Final Thoughts

AI-powered billing systems are not just another tech trend — they’re becoming a core part of modern business operations.

By combining automation, intelligence, and real-time analytics, these systems are redefining what accuracy means in invoicing.

From eliminating human mistakes to improving fraud detection and forecasting payments, AI ensures that every invoice tells the right story — clean, correct, and timely.

Boost your business efficiency with Kenfra BillPad — a next-generation smart billing platform from Kenfra, designed to simplify invoicing and financial management for businesses, service providers, and agencies across India.

Leave a Reply