How Cloud-Based Billing Helps Small Businesses Save Time?

Kenfra Research - Bavithra2025-11-05T09:27:44+05:30In today’s fast-moving business world, time is one of the most valuable resources for any small business. From managing customers and handling payments to tracking expenses, every minute matters. That’s where cloud-based billing comes in a modern, efficient way to simplify your billing process and save hours each week.

Whether you’re running a small retail shop, a digital marketing agency, or a home-based business, cloud billing software can help you work smarter, not harder. But before we dive into how it saves time, let’s understand what cloud-based billing really means and how it differs from traditional billing systems.

What Is Cloud-Based Billing?

Cloud-based billing is a digital invoicing and payment system that works entirely online. Instead of manually creating invoices using paper or Excel sheets, everything happens through a cloud platform.

Your data, including customer information, invoices, and payment records is stored securely on remote servers, which you can access anytime, from anywhere, using an internet connection.

Traditional Billing vs. Cloud-Based Billing

To understand how cloud billing helps small businesses save time, it’s important to see the difference between traditional and cloud-based systems.

As you can see, the cloud-based billing system removes many of the slow, manual steps that traditional billing involves.

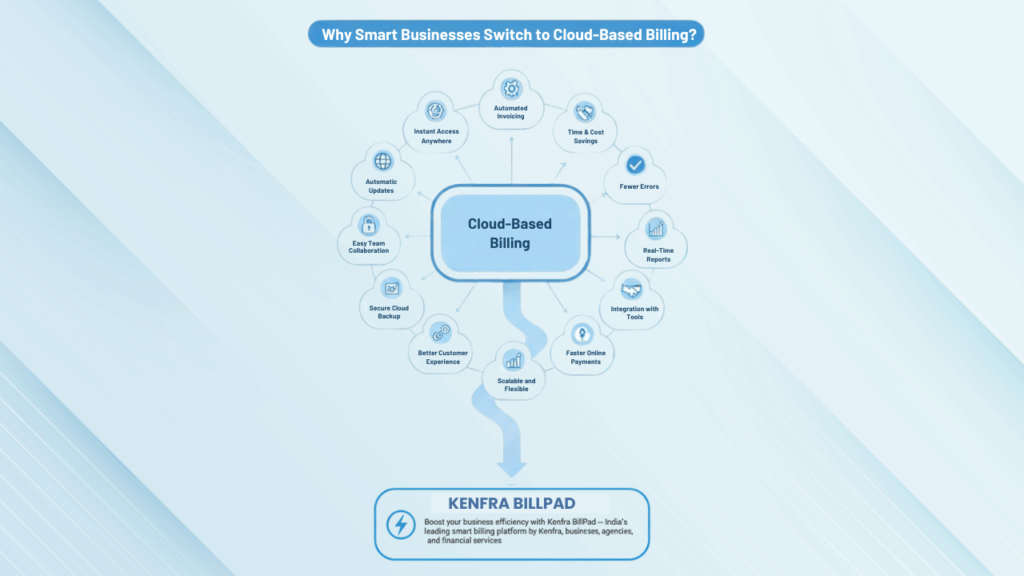

Why Cloud-Based Billing Is Better Than Traditional or Normal Billing?

When comparing cloud-based billing with traditional or normal billing methods, the difference is clear. Cloud billing helps small businesses save time, reduce errors, and simplify daily operations. Here’s how it gives you a major edge over the old way of doing things:

1. Instant Access Anytime, Anywhere

With traditional billing, you’re often tied to your office computer or a specific location to send invoices or check payments.

Cloud-based billing removes that limitation completely. You can access your billing dashboard from anywhere whether you’re at home, traveling, or meeting a client.

All you need is an internet connection, and you can create, edit, or review invoices instantly. This flexibility helps small business owners handle urgent billing tasks on the go and saves hours every week compared to the slow, location-bound traditional process.

2. Automated Invoicing Saves Hours Every Month

Manual invoicing under normal billing systems is repetitive and time-consuming. You have to enter data, create invoices one by one, and remember payment dates.

Cloud-based billing automates these tasks effortlessly. You can schedule recurring invoices, use ready-made templates, and even set up automatic reminders for late payments.

For small businesses offering monthly or subscription services, this automation is a game changer. Instead of spending hours every month on manual work, the system handles it all for you saving both time and effort.

3. Fewer Errors and Manual Work

Traditional billing often leads to human mistakes — wrong totals, missing tax details, or duplicate entries. Fixing these errors can waste valuable time and create confusion with clients.

With cloud billing software, calculations for taxes, discounts, and totals are automated. The system ensures accuracy every time, reducing the chances of costly billing errors.

This reliability not only saves time but also helps maintain your professional reputation something manual billing can easily jeopardize.

4. Real-Time Updates and Reports

Generating reports in traditional billing systems usually means digging through spreadsheets or paper files. It’s slow and often outdated by the time you finish.

Cloud-based billing provides real-time financial data and instant reports. You can check unpaid invoices, revenue trends, and cash flow from a single dashboard.

Having accurate, live insights helps you make faster business decisions something traditional systems simply can’t match.

5. Simplified Collaboration

In normal billing setups, sharing files between your team or accountant is a hassle. You often end up emailing documents back and forth or saving multiple versions.

Cloud billing makes collaboration smooth and instant. Multiple users like accountants, managers, or business owners can log in and work together in real time.

This teamwork speeds up approvals, reduces miscommunication, and keeps everyone on the same page, unlike the delays of manual billing systems.

6. Automatic Backups and Better Security

Traditional billing relies on local files, which can be lost or damaged due to system crashes or hardware failure. Recovering that data can take days or may not be possible at all.

Cloud-based billing automatically stores all your data on secure, encrypted servers with regular backups. You never have to worry about losing important financial records.

This level of security and reliability is a huge improvement over traditional storage methods, giving small businesses peace of mind.

7. Faster Payments with Online Options

Getting paid faster is one of the biggest advantages cloud billing has over normal billing.

Traditional billing often involves sending invoices manually and waiting days (or weeks) for checks or bank transfers. Cloud billing systems let you connect online payment gateways like PayPal, Stripe, or Razorpay directly to your invoices.

Customers can pay instantly with just one click. This not only improves cash flow but also saves you the time spent chasing overdue payments.

8. Seamless Integration with Other Business Tools

Traditional billing systems often work in isolation. If you want to sync data with your accounting or CRM software, you have to do it manually.

Cloud-based billing platforms integrate smoothly with other tools like inventory management, accounting, and CRM systems.

This means when you create or update an invoice, all related data automatically updates across your connected systems. The result? No duplicate work, fewer errors, and a lot of time saved.

9. Scalability and Flexibility

As your business grows, normal billing systems may need costly upgrades or new hardware to handle more data.

Cloud-based billing, on the other hand, scales effortlessly. You can add more users, serve more clients, or process more invoices without worrying about storage limits or extra setup costs.

This flexibility makes it easy for small businesses to grow without being held back by their billing software.

10. Better Customer Experience

Traditional billing often means slower response times and limited payment options. Cloud billing changes that completely.

You can send professional, detailed invoices quickly and include online payment links directly in the email. Customers appreciate the ease and speed, which builds trust and encourages repeat business.

When your billing process is smooth and efficient, your customer experience automatically improves helping your business stand out.

Why Small Businesses Should Switch to Cloud Billing?

Small businesses often run with limited staff and tight schedules. Every hour saved in administration can be used for core business activities like marketing, customer service, or product development.

By switching to cloud-based billing, you gain:

- Time efficiency – automated invoicing, faster payments, and easy reporting

- Cost savings – no need for hardware, IT maintenance, or paper

- Accuracy – reduced human error

- Mobility – access from anywhere

- Security – data protected with encryption and backups

In short, cloud billing is not just a tech upgrade it’s a smarter way to manage your business.

Final Thoughts

In a competitive market, small businesses can’t afford to waste time on manual billing. Cloud-based billing offers an affordable, reliable, and time-saving solution that simplifies the entire process from creating invoices to getting paid.

By automating tasks, improving accuracy, and providing instant access to financial data, cloud billing helps you focus on what truly matters growing your business.

Boost your business efficiency with Kenfra BillPad — India’s leading smart billing platform by Kenfra, crafted for financial services, businesses, and agencies alike.