The Hidden Benefits of Instant Digital Receipts You Didn’t Know

Kenfra Research - Bavithra2026-01-23T17:42:37+05:30Instant digital receipts are more than just a modern replacement for paper slips. They are smart financial tools that help people track expenses, save time, protect the environment, and manage money better. Many users receive digital receipts every day but don’t realize how powerful they really are. In simple terms, instant digital receipts give you proof of payment immediately after a transaction — and they do much more than just confirm a purchase.

What Are Instant Digital Receipts?

Instant digital receipts are electronic records of a transaction that are delivered immediately after payment via email, SMS, or a mobile app. They contain essential details such as the transaction amount, date and time, merchant name, payment method, and a reference or transaction ID. Unlike traditional paper receipts, instant digital receipts are stored securely in digital format, making them easy to access, search, and retrieve at any time. They offer a convenient, eco-friendly, and efficient way for customers and businesses to keep accurate payment records.

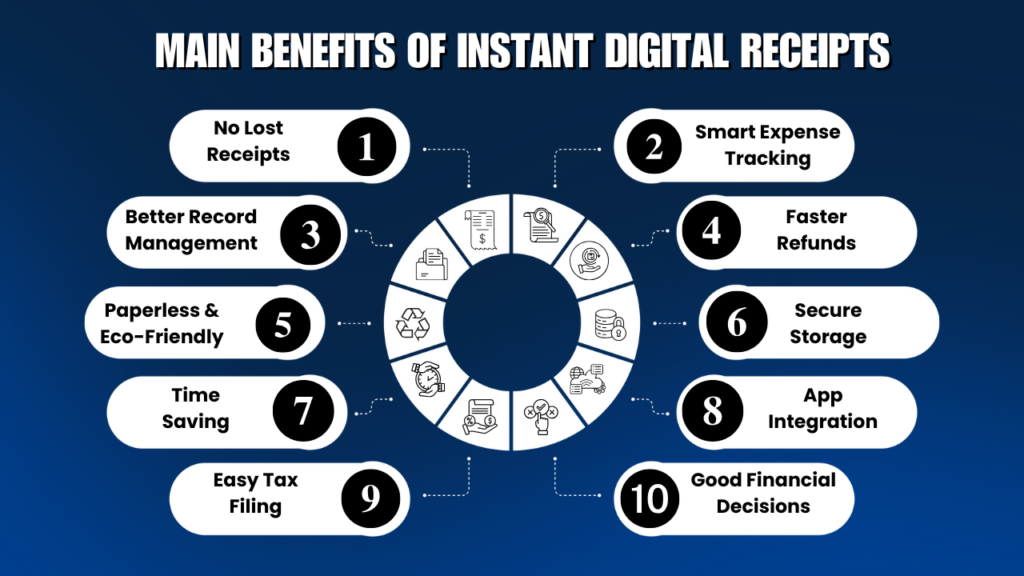

What Are the Main Benefits of Instant Digital Receipts?

1. No More Lost Receipts Ever Again

Instant digital receipts are stored securely on your phone, email, or app, so they never fade, tear, or get misplaced like paper receipts. This makes them ideal for expense tracking, refunds, warranty claims, and tax filing. With a digital receipt system, you can quickly search and retrieve any transaction within seconds, improving convenience and accuracy.

2. Smarter Expense Tracking Made Easy

One of the key digital receipts benefits is automated expense tracking. Digital receipts can be categorized and organized automatically, helping users monitor monthly spending and identify unnecessary expenses. Freelancers, salaried individuals, and small businesses gain better financial visibility without manual data entry.

3. Better Financial Record Management

Instant digital receipts simplify financial record management by keeping all transaction data in one place. They reduce manual work, minimize human errors, and make audits more efficient. Businesses handling frequent transactions benefit from accurate, well-organized digital financial records.

4. Faster Refunds and Hassle-Free Returns

Electronic receipts provide instant proof of purchase, making refunds and returns quicker and smoother. Customers no longer need to search for paper slips, and merchants can verify transactions easily. Digital payment receipts reduce disputes and speed up refund processing.

5. Environment-Friendly and Paperless

Paperless receipts help reduce environmental impact by cutting down paper usage and printing chemicals. Switching to eco-friendly digital receipts lowers waste and supports sustainability efforts. It’s a simple yet effective way for businesses and consumers to contribute to a greener future.

6. Secure and Safe Storage

Instant digital receipts are protected with encryption and cloud storage, making them more secure than paper receipts. They remain safe even if your phone is lost or damaged. With backup and secure access anytime, electronic receipts offer long-term reliability.

7. Time-Saving for Businesses and Customers

Digital receipts speed up the checkout process by eliminating printing delays. Customers receive receipts instantly, while businesses reduce operational costs and manage transactions more efficiently. An instant receipt system improves customer experience and saves valuable time.

8. Easy Integration with Finance Apps

Modern finance apps can automatically sync instant digital receipts, keeping transaction records updated in real time. This integration improves accuracy in reports and simplifies financial planning. Users can manage spending, savings, and financial health from one dashboard.

9. Helpful for Tax Filing and Compliance

Digital payment receipts make tax filing easier by keeping expense records organized and accessible. They provide clear proof of transactions and help reduce filing errors. Businesses can also maintain compliance with financial regulations using electronic receipts.

10. Supports Better Financial Decisions

Instant digital receipts provide clear insights into spending habits and transaction patterns. As a result, this helps users control unnecessary purchases, improve savings, and build better financial discipline. Furthermore, over time, access to accurate digital records ultimately leads to smarter financial decisions.

FAQs – Instant Digital Receipts

1. What is an instant digital receipt?

An instant digital receipt is an electronic proof of payment that is sent immediately after a transaction through email, SMS, or a mobile app. It contains key transaction details and is stored digitally for easy access.

2. Are instant digital receipts legally valid?

Yes, instant digital receipts are legally valid and widely accepted for refunds, audits, accounting, and tax purposes. They meet legal requirements in most regions just like paper receipts.

3. Can digital receipts replace paper receipts?

Yes, digital receipts can fully replace paper receipts for most personal and business transactions. Many merchants and organizations now prefer electronic receipts due to convenience and accuracy.

4. Are instant digital receipts safe to use?

Yes, instant digital receipts are safe to use as they are stored securely using encryption and cloud technology. This reduces the risk of loss, damage, or fading compared to paper receipts.

5. Who should use instant digital receipts?

Anyone looking for better expense tracking, improved financial control, and paperless record management can benefit from instant digital receipts, including individuals, freelancers, and businesses.

Conclusion

The hidden benefits of instant digital receipts go far beyond simple convenience. For example, they help users track expenses accurately, while also enabling them to manage financial records efficiently. Moreover, they save time, reduce paper waste, and consequently help people make smarter money decisions. As digital payments continue to grow, electronic receipts are becoming an essential part of modern, organized, and eco-friendly financial life. If you’re looking for a smarter way to manage your financial records and transactions, Kenfra Finstar offers a powerful finance app with a free trial. It is designed to simplify expense tracking, manage instant digital receipts, and improve overall financial management—all in one place.

Leave a Reply