Why Recurring Deposits Are the Smart Way to Start Saving Regularly?

Kenfra Research - Bavithra2026-02-13T17:20:07+05:30Saving money is very important for a secure future. But many people find it hard to save regularly. If you want to save money without stress, a Recurring Deposit (RD) is one of the best options. In this blog, we will explain what an RD is, how it works, and why it is a smart way to save money every month.

What is a Recurring Deposit?

A Recurring Deposits (RD) is a financial product offered by banks and financial institutions where you deposit a fixed amount every month for a predetermined period. The bank pays you interest on your deposits, and at the end of the term, you receive your principal amount along with the interest earned.

Think of it as a savings plan with discipline. Unlike a regular savings account where you might be tempted to withdraw money, an RD locks your money for a fixed period, helping you save consistently.

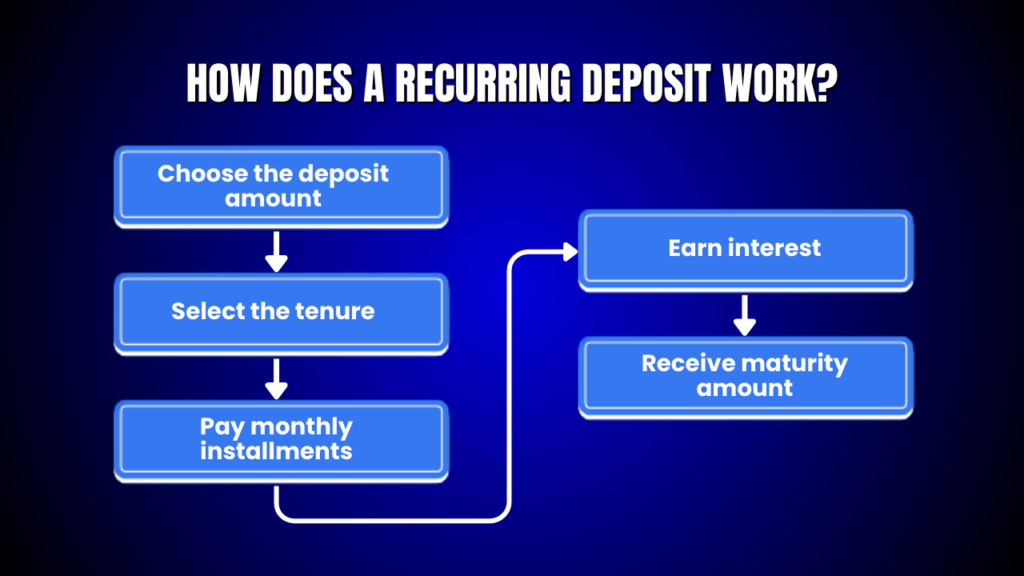

How Does a Recurring Deposit Work?

The mechanics of an RD are simple:

- Choose the deposit amount: Decide how much money you want to save each month. This can be as low as ₹500 in many banks.

- Select the tenure: Pick a term for your RD, usually ranging from 6 months to 10 years.

- Pay monthly installments: You deposit the chosen amount every month.

- Earn interest: The bank calculates interest on your monthly deposits, typically compounded quarterly.

- Receive maturity amount: At the end of the term, you get your deposited money plus interest.

For example, if you save ₹5,000 per month for 2 years at an interest rate of 6.5% per annum, you will receive your total deposits plus the interest at maturity. This steady growth makes RDs a perfect way to plan for short-term or medium-term goals.

Benefits of Recurring Deposits

1. Encourages Disciplined Savings

The biggest advantage of an RD is that it promotes regular saving habits. When you commit to depositing a fixed amount every month, you automatically learn to budget and prioritize savings over impulsive spending.

2. Safe Investment Option

Unlike stocks or mutual funds, RDs are considered a low-risk investment. They are backed by banks, so your money is safe. If you want a risk-free way to grow your savings, RDs are ideal.

3. Attractive Interest Rates

Recurring deposits usually offer higher interest rates than regular savings accounts. While savings accounts give around 3-4% interest, RDs often range between 5-7% per annum, depending on the bank and tenure. Some banks even offer slightly higher rates for people aged 60 and above.

4. Flexible Tenure and Deposit Amount

Whether you can save ₹500 or ₹50,000 per month, RDs are flexible. You can choose a tenure that suits your financial goal—short-term for 6 months or long-term for several years.

5. Goal-Based Savings

RDs are perfect for financial goal planning. Whether you’re saving for a vacation, buying a car, or building an emergency fund, an RD allows you to systematically accumulate money for your target.

6. Easy to Open and Manage

Opening an RD is simple. Most banks allow you to open one online in just a few minutes. Monthly installments can also be automatically deducted from your savings account, making it completely hassle-free.

Tips to Maximize Your RD Benefits

- Start Early: Even small monthly contributions grow significantly due to the power of compounding.

- Choose the Right Tenure: Longer tenures often yield higher interest, but consider your liquidity needs.

- Automate Deposits: Set up auto-debit to ensure you never miss a monthly installment.

- Compare Rates: Different banks offer different rates. Look for the best rate before opening an RD.

- Avoid Premature Withdrawal: Early withdrawal usually attracts penalties and lower interest.

RD vs Savings Account: Why RD Wins for Regular Saving

Feature | Savings Account | Recurring Deposit |

Interest Rate | 3-4% | 5-7% |

Risk | Low | Low |

Discipline | Low | High |

Goal Planning | Difficult | Easy |

Liquidity | High | Locked for tenure |

While a savings account is great for emergencies, RDs ensure disciplined, goal-oriented saving with better returns.

Frequently Asked Questions About Recurring Deposits (RD)

1. Why is a recurring deposit important?

A recurring deposit is important because it helps you save money regularly and safely. It gives you a fixed interest on your savings, so your money grows over time. It is a simple way to plan for future expenses like education, travel, or emergencies.

2. What are the benefits of a recurring deposit?

The main benefits of an RD are:

- Regular Savings: Encourages you to save every month.

- Safe Investment: Your money is safe with the bank.

- Earn Interest: Usually gives higher interest than a savings account.

- Flexible: You can choose how much to save and for how long.

- Financial Planning: Helps in planning for future goals.

- Tax Benefits: Some RDs offer tax savings under Section 80C.

3. Why is it important to save regularly?

Saving regularly is important because it builds financial discipline and helps you prepare for the future. Even small amounts saved every month can grow into a big sum over time. It also ensures you have money for emergencies or important goals without borrowing.

4. Why is RD important?

RD is important because it makes saving easy and automatic. It gives guaranteed returns, helps you plan financially, and encourages a habit of saving every month. It is one of the safest ways to grow your money without taking risks.

Conclusion

Recurring Deposits are one of the smartest ways to start saving regularly. They combine the power of discipline, guaranteed returns, and safety, making them suitable for beginners and conservative investors alike.

Start small, stay consistent, and watch your money grow steadily. With the right approach, a Recurring Deposit can be your trusted partner on the path to financial security. Choose a trusted platform like Kenfra Finstar, the best finance application in India, to start and track your savings journey with confidence.

Leave a Reply