E-Invoicing in 2026: Regulatory Updates and What Businesses Must Know

Kenfra Research - Bavithra2025-11-17T17:22:12+05:30E-Invoicing 2026 is set to change how businesses create, share, and store invoices. With governments across different regions tightening compliance rules and pushing for digital-first systems, companies small or large must understand what is coming next. From updated formats to stricter reporting timelines, e-invoicing regulations are evolving fast. This guide breaks down everything businesses need to know in simple words so they can stay compliant and avoid penalties.

What Is E-Invoicing and Why Is It Growing in 2026?

Electronic invoicing, or e-invoicing, means generating invoices in a standard digital format that can be validated by government systems in real time. Many countries began adopting e-invoicing earlier, but 2026 is the year when several new rules and expansions will go live.

Governments support e-invoicing because it helps reduce tax fraud, improves accuracy, speeds up invoice approvals, and enables businesses to automate billing. With the new e-invoice mandates, companies can no longer rely on outdated paper or PDF-based manual processes. Transitioning to digital invoicing is now essential for staying compliant and taking advantage of the many operational benefits it offers, including faster processing and reduced errors.

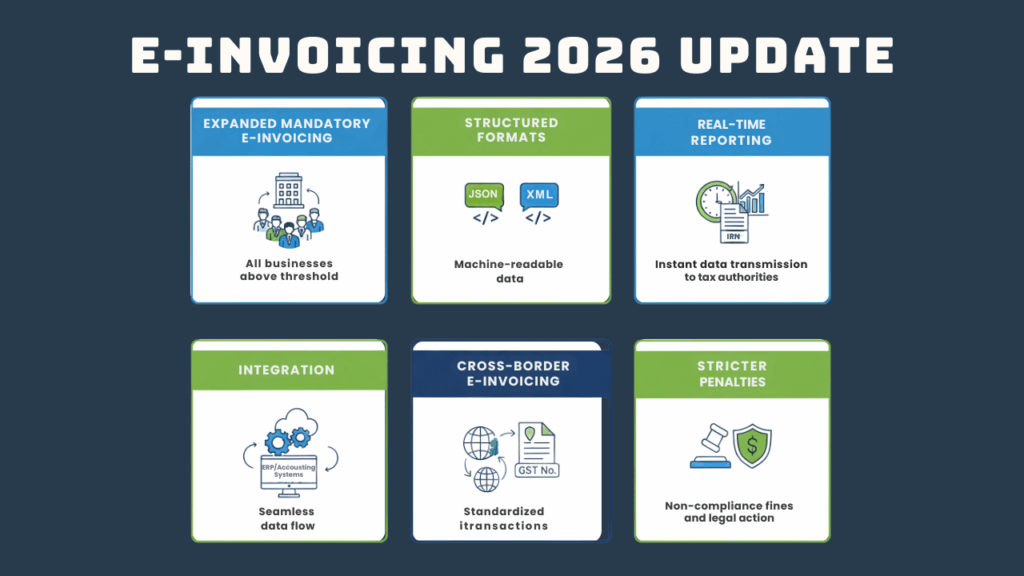

Key Regulatory Updates for E-Invoicing in 2026

Below are the most important updates that businesses must prepare for.

1. Expanded Eligibility for Mandatory E-Invoicing

Many countries are lowering the turnover threshold for mandatory e-invoicing. Even small and medium businesses will be required to generate GST e-invoice compliant documents. This means software adjustments, staff training, and updated workflows.

2. New Standard Formats

Authorities are pushing for structured invoice formats such as JSON or XML. These formats allow quick validation and faster data exchange between businesses and tax portals.

3. Real-Time Invoice Reporting

One major shift in E-Invoicing 2026 is real-time reporting. Invoices must be uploaded to government systems immediately or within a few minutes. This reduces errors and eliminates backdated entries.

4. More Integration With Accounting and ERP Systems

Governments are encouraging businesses to use automated billing systems instead of uploading invoices manually.

This includes:

- API-based reporting

- Auto-generation of IRN (Invoice Reference Numbers)

- QR-code embedded invoices

5. Cross-Border E-Invoicing

International trade is also adopting a uniform structure. Businesses dealing with imports and exports will need to follow digital invoicing compliance rules for cross-border trade, helping reduce delays and mismatches.

6. Stricter Penalties for Non-Compliance

Under new e-invoicing regulations, penalties may apply for:

- Not generating e-invoices

- Generating invoices in the wrong format

- Incorrect or missing data

- Late reporting

How E-Invoicing 2026 Will Impact Businesses?

1. Faster Payments

Digital invoices reduce approval times, helping businesses receive payments sooner.

2. Lower Operational Costs

With automation in invoicing, companies save on:

- Paper

- Printing

- Storage

- Manual labour

3. Improved Accuracy

Automated systems reduce human error, lowering the chances of mismatched entries, tax errors, or rejected invoices.

4. Easier Audits

With all invoices stored digitally and verified by government systems, audits become smoother and faster.

5. Better Cash Flow Management

Consistent invoicing patterns help businesses predict revenue cycles more accurately.

Steps Businesses Should Take to Stay Ready for E-Invoicing 2026

1. Switch to an E-Invoicing Compatible Billing Software

Choose a solution that supports government-approved formats, automatic GST validation, and API integration. A modern business invoicing system not only ensures smooth compliance with regulatory requirements but also reduces manual workload, making the invoicing process faster, more accurate, and less prone to errors. By adopting such a system, businesses can streamline operations, stay compliant, and improve overall efficiency.

2. Train Your Finance and Accounting Team

Your staff should be well-versed in several key areas to ensure smooth compliance. They need to understand the new invoice format requirements, the process flow from invoice creation to reporting, and how to handle errors effectively. Additionally, it’s crucial that they are aware of the updated compliance deadlines to avoid penalties and ensure timely reporting. Proper training will help streamline operations and keep your business on track with evolving regulations.

3. Standardize Invoice Data

Ensure customer names, GST numbers, product details, and tax details are accurate and updated. Incorrect data can cause invoice rejection.

4. Automate Where Possible

Automation plays a crucial role in e-invoicing by enabling real-time reporting, preventing duplicates, and automatically adding mandatory fields. It also helps in reducing mistakes, ensuring that the invoicing process is more efficient and accurate. By automating these tasks, businesses can streamline their operations, minimize human errors, and stay compliant with new regulations.

5. Monitor Regulation Updates Throughout 2026

Since rules will continue evolving, staying updated is essential.

Benefits of Following the New E-Invoicing Regulations

1. Stronger Business Credibility

Companies that follow digital invoicing compliance rules appear more professional and trustworthy.

2. Better Record Keeping

Digital storage is easier to manage than piles of paper.

3. Smooth Integrations

E-invoicing allows integration with:

- Accounting systems

- Inventory management

- ERP solutions

4. Enhanced Security

Digital invoices reduce fraud chances and offer traceability.

Common Challenges Businesses Might Face

1. Transitioning From Manual to Digital

Companies used to paper-based processes may find the change difficult initially.

2. Learning New Systems

Staff may take time to adjust to new billing software and reporting tools.

3. Handling Technical Errors

API failures or missing fields can cause invoice rejections.

4. Cost of Upgrading Systems

Some businesses might worry about software costs, though many affordable solutions exist.

FAQs About E-Invoicing 2026

1. Who must use e-invoicing in 2026?

Most businesses will fall under the updated threshold. The rules apply to companies of all sizes depending on country-specific regulations.

2. Can small businesses generate e-invoices easily?

Yes. Many simple billing apps help small businesses create compliant invoices without complex setups.

3. What happens if a company does not follow e-invoice rules?

Penalties may apply, including fines or rejection of invoices.

4. Do e-invoices replace paper invoices completely?

Yes, for compliance purposes. You can still keep a printed copy, but the official invoice must come from the digital system.

5. What is the biggest advantage of e-invoicing?

Faster processing, error-free billing, and smooth compliance.

Conclusion

As E-Invoicing 2026 rolls out with new rules, businesses should act early. Updating systems, training staff, and choosing the right billing software will make the transition smooth. Digital invoicing is not just a compliance requirement—it is a smarter, faster, and more efficient way to run your business.

If you want an easy, reliable, and compliant solution, try Kenfra BillPad.

At Kenfra, we offer a simple and powerful billing app with a free trial so your business can stay ready for the future of invoicing.

Leave a Reply