Emerging Trends in Carrier Billing: What Businesses Need to Know in 2026?

Kenfra Research - Bavithra2025-11-10T09:32:37+05:30The world of digital payments is evolving faster than ever, and one of the key innovations transforming online transactions is carrier billing. As mobile usage continues to rise, businesses are looking for payment options that are fast, secure, and convenient. Carrier billing offers exactly that — a seamless way for customers to make purchases directly through their mobile network operator.

In 2026, carrier billing is expected to become a major payment method in digital commerce, gaming, streaming, and online subscriptions. In this blog, we’ll explore what carrier billing means, how it works, and the emerging trends shaping its future in 2026.

What Is Carrier Billing?

Carrier billing (also called Direct Carrier Billing) is a payment method where users can buy digital items and have the amount added to their mobile phone bill or deducted from their prepaid balance.

In simple words — you don’t need a card or bank account. You just confirm your mobile number, approve the payment, and it’s done. For Example: When you buy a game, app, or subscription, you can pay through your mobile operator instead of entering card details.

Why It’s Useful?

- Easy: Just a few taps to pay.

- Safe: No sharing of card or bank details.

- Accessible: Works even without a bank account.

- Global: Used in many countries for mobile payments.

As mobile shopping grows, carrier billing is becoming a must-have option for digital businesses.

Why Carrier Billing Matters in 2026?

In 2026, people want faster and simpler ways to pay. Carrier billing helps businesses reduce failed payments, boost subscriptions, and reach more mobile users.

By using secure and automated tools like Kenfra BillPad, companies can manage billing easily and keep customers happy.

Carrier billing isn’t just a payment method anymore — it’s a smart way for businesses to grow in the digital era.

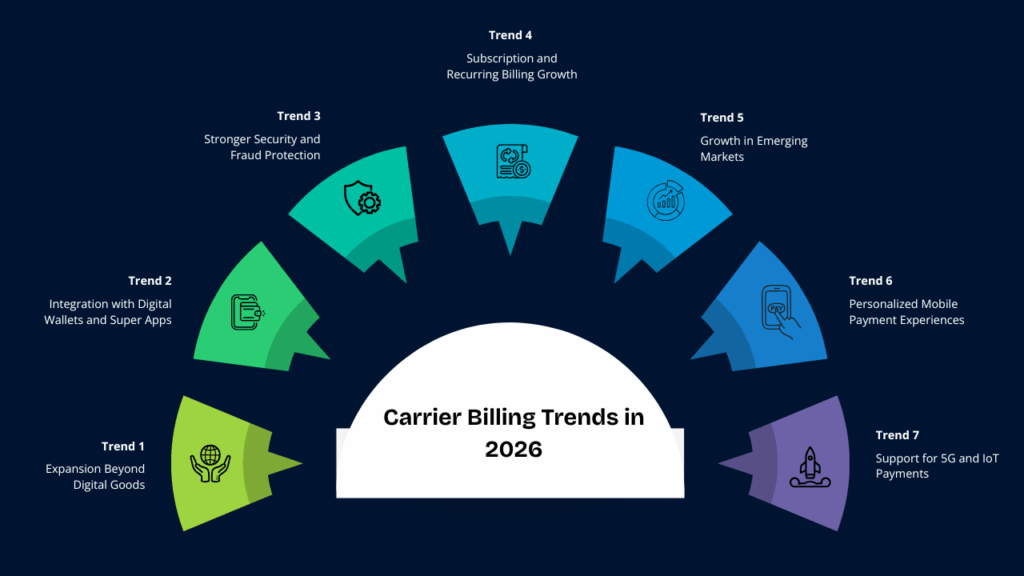

Emerging Trends in Carrier Billing for 2026

Let’s look at the key trends that are redefining the carrier billing landscape in 2026 and beyond.

1. Expansion Beyond Digital Goods

Traditionally, carrier billing was used for digital purchases such as mobile apps, gaming credits, and streaming services. But in 2026, it’s expanding into physical goods and services too.

For instance, users can now pay for food deliveries, ride-hailing, or even retail purchases directly through their mobile carriers. This shift shows how carrier billing is evolving into a universal payment method, not just a digital niche.

Businesses are partnering with telecom providers to enable easy, mobile-first checkout experiences — making payments faster and frictionless.

2. Integration with Digital Wallets and Super Apps

One of the biggest trends in 2026 is the integration of carrier billing with digital wallets like Google Pay, Paytm, and Apple Pay. This allows users to link their carrier accounts to digital wallets for unified mobile payments.

The rise of super apps in Asia, the Middle East, and Africa is further driving this trend. These apps combine shopping, entertainment, and payment features — and carrier billing fits perfectly into their ecosystem.

This integration makes it easier for users to manage transactions while giving businesses multiple touchpoints to engage with customers.

3. Stronger Security and Fraud Protection

With digital payments increasing, so do security concerns. In 2026, carrier billing platforms are implementing multi-factor authentication (MFA), transaction verification, and real-time fraud detection to ensure safety.

Carriers are also working closely with fintech companies and regulators to maintain compliance with data privacy and financial protection laws.

This focus on security builds customer trust, which is critical for widespread adoption of carrier billing in global markets.

4. Subscription and Recurring Billing Growth

Carrier billing is becoming a key tool for managing subscription-based payments in entertainment, streaming, and gaming industries.

Users can subscribe to platforms like Netflix, Spotify, or in-app services and have the fee automatically charged to their phone bill each month.

Businesses benefit from automated recurring payments, while users enjoy frictionless renewals without needing to re-enter payment details.

With more services moving toward subscription models, carrier billing is turning into a preferred recurring payment method in 2026.

5. Growth in Emerging Markets

Carrier billing is witnessing rapid adoption in Asia, Africa, and Latin America, where many users lack access to banking services but have mobile phones.

Telecom operators in these regions are expanding their mobile money ecosystems, allowing millions of users to transact online safely.

This trend opens new opportunities for businesses to tap into previously unreachable markets through mobile-first billing solutions.

In 2026, businesses entering developing markets will likely prioritize carrier billing integration to attract and retain customers.

6. Personalized Mobile Payment Experiences

In 2026, personalization is at the core of all digital services — and carrier billing is no exception.

Businesses are using customer data and analytics to tailor offers, suggest subscriptions, and provide flexible payment plans.

This data-driven personalization improves customer satisfaction and builds long-term loyalty.

As users become more comfortable paying through their mobile networks, personalized carrier billing will drive higher engagement and retention rates.

7. Support for 5G and IoT Payments

The arrival of 5G technology and Internet of Things (IoT) devices is reshaping how payments happen. Carrier billing will soon support payments for connected devices — from smartwatches and TVs to electric vehicles and home assistants.

For instance, users could pay for a connected car service or smart appliance upgrade through their mobile carrier.

This trend will open up new business models and revenue streams for both telecom providers and enterprises across industries.

Conclusion

Carrier billing is changing the way businesses and consumers think about payments. It removes the barriers of cards and bank accounts, allowing millions of people to make secure digital transactions with just a mobile phone.

For businesses, adopting this payment method through trusted billing software like Kenfra BillPad ensures faster transactions, better customer satisfaction, and a stronger digital presence in the evolving global marketplace.

Leave a Reply