How Is Daily Interest Calculated on Loans? A Beginner’s Guide

Kenfra Research - Bavithra2026-01-29T17:18:47+05:30Daily interest on loans are calculated by applying the annual interest rate to the outstanding loan balance each day and dividing it by 365. This means interest builds daily instead of monthly, which directly affects how much you repay over time.

Many borrowers do not realize how daily interest works or how even small payment delays can increase loan costs. In this beginner’s guide, you’ll learn how daily interest is calculated on loans, see easy examples, and understand how it impacts your EMI, total interest, and repayment savings.

What Is Daily Interest on Loans?

Daily interest means the interest on your loan is calculated every day based on the remaining loan balance. Instead of charging interest once a month, lenders calculate how much interest you owe each day. This method is commonly used because it reflects your exact loan balance. If your balance goes down, your daily interest also goes down. If your balance stays high, interest continues to grow daily. You can even track your daily interest and manage payments easily using a finance app, which helps you stay on top of your loan balance and save money over time.

Why Do Lenders Use Daily Interest?

Lenders use daily interest because it allows them to calculate interest more accurately. Since loan balances can change due to payments or missed payments, daily interest ensures the interest charged matches the exact amount owed. As a result, it provides a more precise reflection of the borrower’s debt. On the other hand, from the borrower’s side, daily interest can be helpful or costly. For example, if you make payments early or frequently, you can save money. However, if you delay payments, the interest keeps adding up every day, which can significantly increase the total cost of the loan.

How Is Daily Interest Calculated? (Simple Formula)

Daily interest is calculated by spreading the annual interest rate over each day of the year and applying it to the outstanding loan balance. This method allows lenders to charge interest based on how many days you actually use the borrowed money.

The Simple Daily Interest Formula

Daily Interest = (Outstanding Loan Balance × Annual Interest Rate) ÷ 365

Some lenders may use 360 days instead of 365, but most banks use 365 days for daily interest calculation.

Breaking the Formula in Simple Words

Let’s understand each part of the formula:

- Outstanding Loan Balance

This is the amount you still owe on the loan. As you pay EMIs, this amount reduces. - Annual Interest Rate

This is the interest rate charged by the lender per year (for example, 10%). - 365 Days

The annual interest is divided by 365 to find the interest charged per day.

Each day, interest is calculated on the remaining loan balance, not the original loan amount.

Daily Interest Calculation Example

Suppose:

- Loan amount: ₹100,000

- Annual interest rate: 10%

- Outstanding balance: ₹100,000

Step 1: Convert interest rate to decimal

10% = 0.10

Step 2: Apply the formula

Daily Interest = (100,000 × 0.10) ÷ 365

Daily Interest = ₹27.40 (approx.)

This means ₹27.40 of interest is added every day until you make a payment.

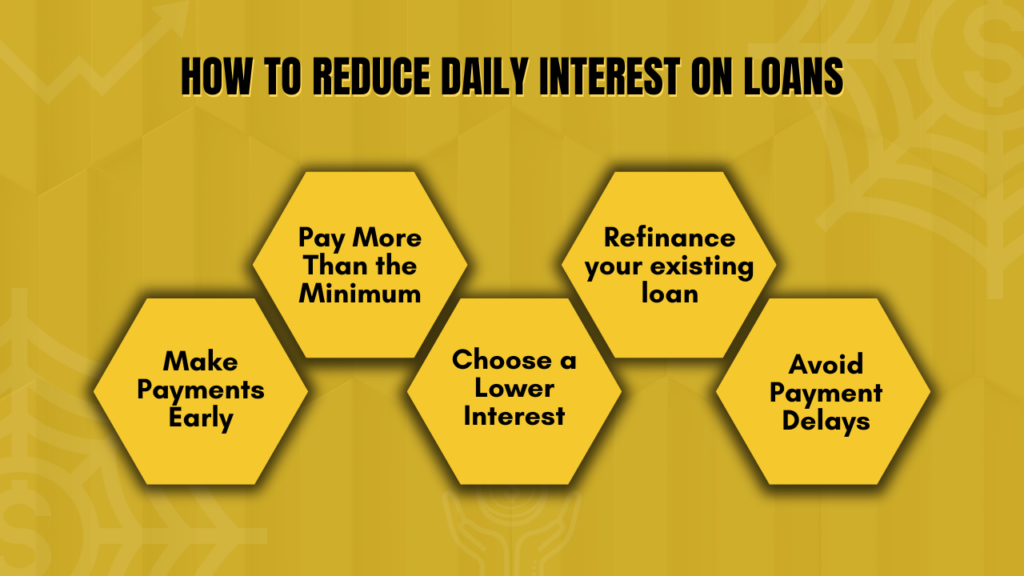

How to Reduce Daily Interest on Loans?

Here are simple ways to reduce daily interest on your loans. By following these steps, you can save money and pay off your loan faster. Each tip focuses on lowering the interest charged every day. Using a loan tracker can make this even easier, helping you monitor your outstanding balance, track interest accumulation, and plan extra payments effectively.

1. Make Payments Early

Interest is calculated daily, so paying early reduces the loan balance sooner. The lower your balance, the less interest is added each day. Even paying a few days before the due date can make a noticeable difference over time.

2. Pay More Than the Minimum

Extra payments go directly toward the principal, which reduces future interest charges. Paying only the minimum keeps your balance higher for longer, increasing total interest. By paying a bit more each month, you can shorten your loan term and save money.

3. Choose a Lower Interest Rate

Even a small reduction in interest rate can save you thousands over the life of the loan. Lower rates reduce the amount of daily interest added to your balance. You can compare lenders or negotiate for better rates before taking a loan.

4. Refinance Your Loan

Refinancing means replacing your current loan with a new one that has better terms. A lower interest rate or longer repayment term can reduce daily interest and monthly payments. Make sure to check for any fees before refinancing to ensure it actually saves you money.

5. Avoid Payment Delays

Missed or late payments increase interest and can trigger penalties. Daily interest keeps adding until the payment is made, which raises the total loan cost. Setting up reminders or auto-payments can help you stay on schedule and reduce unnecessary charges, while timely payments also help speed up cashflow, freeing up money for other financial goals.

Frequently Asked Questions

1. How is daily interest calculated on loans?

Daily interest is calculated by dividing the annual interest rate by 365. The daily rate is then multiplied by your remaining loan balance. This gives the interest charged for one day.

2. Is daily interest good or bad?

Daily interest can be good if you make early or extra payments. Paying sooner reduces your loan balance and lowers total interest. However, delaying payments can increase your overall loan cost.

3. Do all loans use daily interest?

No, not all loans use daily interest. Many personal loans, student loans, and credit cards use daily interest. Some loans calculate interest monthly or use compound interest instead.

4. Can I reduce daily interest?

Yes, you can reduce daily interest by paying early or making extra payments. Lowering your loan balance reduces the interest charged each day. Refinancing at a lower interest rate can also help.

5. Why does my loan balance change every day?

Your loan balance changes because interest is calculated daily. Each day, interest is added based on the remaining balance. This makes the total amount you owe change slightly every day.

Final Thoughts

Now that you clearly understand how daily interest is calculated on loans and why it matters, it’s important to note that while daily interest may seem confusing at first, it becomes much simpler once it is broken down into easy steps. By following these steps, you can easily track and manage the interest accruing on your loan, making it easier to understand and control the total cost over time.

If you are taking a loan or already repaying one, always check how interest is calculated by your lender. Trusted financial providers like Kenfra Finstar help borrowers understand interest calculations clearly, making it easier to save money, reduce debt faster, and manage loans with confidence.

Leave a Reply