Invoice Like a Pro: Step-by-Step Strategies for Smooth and Professional Billing

Kenfra Research - Bavithra2025-11-20T17:19:57+05:30If you want to grow your business, build trust with clients, and get paid faster, learning how to Invoice Like a Pro is essential. A clean, clear, and well-structured invoice shows professionalism and helps you avoid confusion, delays, and unnecessary back-and-forth messages. Whether you run a small business, offer services, freelance, or manage daily sales, improving your invoicing system can make your entire billing workflow smoother and stress-free.

This guide breaks down simple, practical steps to help you create professional invoices, avoid common billing mistakes, and build a faster, more reliable business payment system.

Why Professional Invoicing Matters?

Professional invoicing creates a strong first impression. When a client receives a clean, well-structured invoice, they immediately see your reliability. This reduces questions, speeds up payments, and keeps your workflow organized.

A good invoice also becomes part of your brand. Over time, it creates a consistent image that clients remember and trust. And most importantly, it helps you keep track of your income, taxes, and financial records without unnecessary headaches.

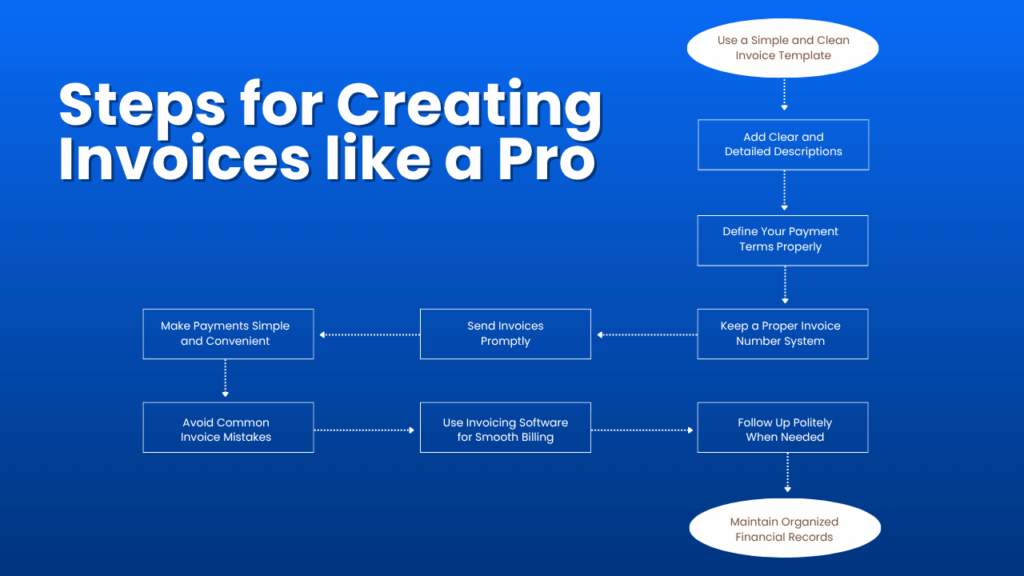

10 Steps for Creating Invoices like a Pro

Step 1: Use a Simple and Clean Invoice Template

One of the easiest ways to look professional is by using a simple, readable invoice template. Avoid clutter or complicated designs. You want the client to understand everything at a glance.

A clean template includes your business details, client information, invoice number, billing date, itemized list of services, total amount, and payment instructions. When these sections are clear, your billing process becomes smoother because clients have all the information they need right away.

Most businesses now prefer using invoicing software because it automatically structures all these details in a clean format and maintains consistency with every invoice you send.

Step 2: Add Clear and Detailed Descriptions

Clients should never be confused about what they are paying for. When descriptions are vague, back-and-forth messages begin. Clear descriptions eliminate misunderstandings.

Instead of writing something too short like “Service charge,” explain what exactly was done, how much time or quantity was involved, or what deliverables you provided. When clients understand their invoice fully, they are more likely to pay quickly and appreciate your transparency. Good descriptions also protect you during disputes because everything is documented clearly.

Step 3: Define Your Payment Terms Properly

Payment terms guide your client on when and how to pay. Without clear terms, delays are common. Decide upfront whether your payment terms are “Net 7,” “Net 14,” “Net 30,” or immediate. If you want part of the payment before starting work, mention it clearly.

You can also specify the payment methods you accept. Many businesses nowadays prefer digital payments because they are quick and easy for clients. Mention your UPI, bank transfer details, or any other method you prefer. Clear payment terms remove confusion and set professional expectations from the beginning.

Step 4: Keep a Proper Invoice Number System

Invoice numbers are not just for record-keeping—they’re extremely important for tracking your payments. A consistent numbering system helps you locate old invoices, identify unpaid ones, and maintain clean financial records. Your numbering format can be simple, such as sequential numbers, or include the year or month.

The main rule is: be consistent. A good invoicing software automatically manages these numbers so you don’t have to worry about organizing them manually.

Step 5: Send Invoices Promptly

One of the most common reasons for delayed payments is late invoicing. When you take too long to send an invoice, clients may forget about the work or push the payment further. Make it a habit to send invoices immediately after the work is finished or at a fixed date each month if it’s ongoing work. Digital invoices help here because you can create and send them instantly from your phone without preparing anything manually.

Step 6: Make Payments Simple and Convenient

Clients appreciate convenience. The easier your payment process is, the faster you receive your money. Offering digital methods such as UPI, bank transfers, and cards speeds up payments.

Many businesses also include payment links directly inside the invoice (available in many billing apps). This reduces friction because the client can pay with just one click instead of searching for your details. A smooth payment experience reflects professionalism and encourages timely payments.

Step 7: Avoid Common Invoice Mistakes

Small errors can cause big delays. Misspelled names, wrong totals, missing taxes, incorrect dates, or unclear charges often lead to confusion.

Before sending an invoice, take a moment to review all details. Double-check the amount, client information, dates, and descriptions. It’s a small step that saves a lot of time and prevents misunderstandings. Proper accuracy is a key part of professional invoicing.

Step 8: Use Invoicing Software for Smooth Billing

Using invoicing software is one of the best ways to maintain a smooth billing workflow. Unlike manual invoices, software helps you stay organized without needing spreadsheets or long calculations. Everything—from client details to tax calculations—remains in one place.

Most small businesses prefer software because it gives them a reliable way to track payments, manage records, and send invoices instantly. It also helps reduce errors because everything is autofilled and structured properly. This makes work easier and allows business owners to focus on growing their business instead of worrying about billing.

Step 9: Follow Up Politely When Needed

Sometimes clients simply forget to pay. A gentle follow-up usually solves the issue. Send a short, polite message reminding them that the due date is approaching or has passed. Always include the invoice number to avoid confusion.

Following up professionally shows that you value your work and helps maintain healthy business relationships.

Step 10: Maintain Organized Financial Records

Good financial records help you understand your income, plan expenses, and prepare for tax season. Store your invoices properly—either on cloud storage or through your invoicing app. Organized records save you time and help your business look more professional during audits or reviews.

A clean record-keeping system also gives you clarity over your cash flow, which is essential for making smart business decisions.

Frequently Asked Questions:

1. What makes an invoice professional?

Clear structure, accurate details, detailed descriptions, and proper payment terms make an invoice look professional and trustworthy.

2. How do I avoid late payments?

Send invoices on time, keep your terms clear, provide easy payment options, and follow up politely when needed.

3. Do small businesses need invoicing software?

Yes, invoicing software makes the billing process faster, more organized, and less stressful by handling everything from numbering to tracking payments.

4. Are digital invoices better than paper invoices?

Digital invoices are faster, easier to store, and more secure, which makes them popular among modern businesses.

5. How much detail should I include in an invoice?

Enough to ensure the client completely understands what they are paying for. Clear descriptions prevent disputes.

Conclusion

Smooth and professional invoicing is a major key to running a successful and stress-free business. When your invoices are clean, timely, and easy to understand, clients respond better and payments become consistent. With the right tools and habits, you can turn your billing process into a simple, seamless part of your daily workflow.

If you want a fast and reliable way to create invoices, try Kenfra BillPad, an easy-to-use billing software and powerful app with a free trial that helps you send professional invoices in seconds.

Leave a Reply