Say Goodbye to Billing Errors: Go Digital with Kenfra BillPad!

Kenfra Research - Bavithra2025-11-12T17:24:02+05:30Running a business is never easy. Every day, you handle customers, manage stock, and make sure sales run smoothly. In the middle of all this, billing plays a key role — it’s how money flows in and how records stay clear. But even though it seems like a small task, one small mistake can turn into big billing errors. Wrong prices, missed taxes, or misplaced bills can cause confusion, unhappy customers, and even financial loss.

If you’re still using a manual bill book or an old-style billing pad, you’ve probably faced these billing errors more than once. The good news is that you don’t have to keep dealing with them. By going digital with Kenfra BillPad, you can make your billing faster, easier, and completely error-free — every single time.

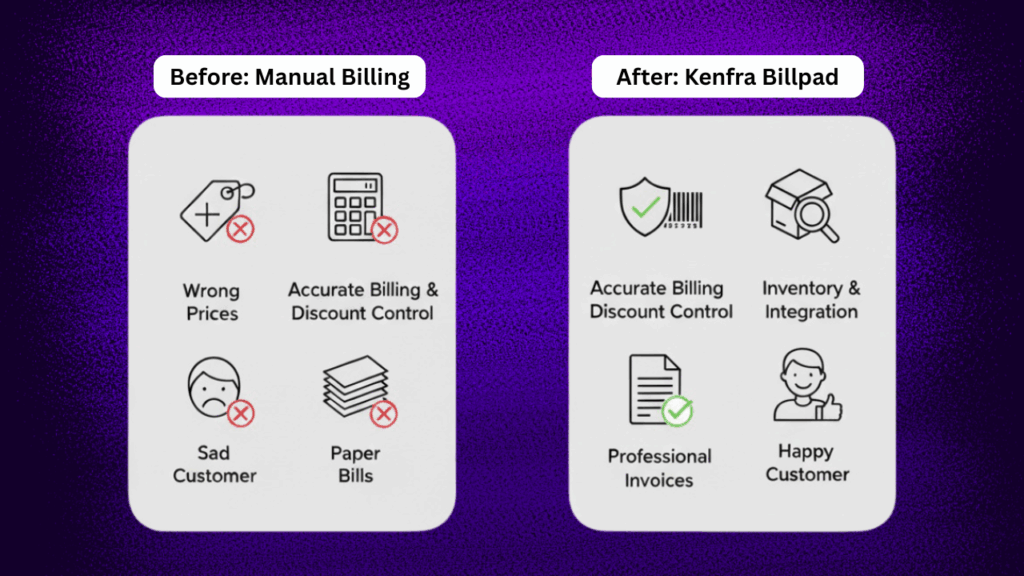

Common Billing Errors in Manual or Old Billing Systems

Switching from paper or generic systems to a dedicated digital billing solution often begins by recognising the many ways things go wrong. Here are typical errors many businesses experience:

a) Data entry errors

- Manual typing of items, rates, quantities often leads to typos, wrong item codes, missing fields.

- Incorrect prices entered (e.g., old price used instead of updated price).

- Mistakes in quantity (especially for weighed items, e.g., produce, groceries) – if the weight or unit is mis-entered, the bill is wrong.

- Incorrect tax rate applied (e.g., GST rate mis-applied or omitted).

b) Pricing / discount / margin errors

- Staff applying wrong discounts or giving unauthorized large discounts, eating into margins.

- Selling below cost or below intended margin because there’s no guardrail.

- Switching between selling‐price and MRP incorrectly, leading to confusion and loss.

c) Inventory mismatches & stock errors

- Bill issued but stock isn’t updated (or updated incorrectly) → errors in available stock and reorder decisions.

- Items sold that aren’t in system (or out of stock) because manual update never happened.

- Bulk price changes not reflected in bills because item master wasn’t updated across all channels.

d) Taxation & compliance errors

- Tax (GST in India) not calculated correctly or omitted entirely.

- Incorrect invoice format (non-compliant with regulations) leading to legal risk.

- Failing to generate e-invoice or e-way bill when required, or doing so manually with mistakes.

e) Multiple channel/order errors

- Separate systems for offline sales and online orders leading to duplication, mismatched bills, or missing entries.

- Delivery/pick-up orders not reflected in billing system; reconciliation issues.

- Branches or counters issuing bills that don’t feed into central system → no consolidated reporting.

f) Reporting & visibility errors

- Because billing is manual, the business lacks real-time and GST-ready data, you don’t know today’s sales, stock levels, or branch performance until much later.

- Mistakes in day-book, GST reports, branch summaries because manual consolidation is error-prone.

- Lack of audit trail: corrections or voids may not be traceable, making mistakes harder to identify.

g) Customer & brand perception errors

- Sloppy invoices: hand-written items, missing details, no branding → looks unprofessional.

- Delays or errors in billing (especially in busy counters) → frustrated customers.

- Missing digital delivery of invoice (via WhatsApp/email) meaning less convenience for customer and less record for you.

All of these individually degrade the billing process, but together they create friction, cost and risk. If you’re still using a “bill-pad style” approach, many of these errors are likely lurking in your workflow.

How Kenfra BillPad is different – and how it solves the error-trap?

Enter Kenfra BillPad. Built with modern business needs in mind, it addresses each of the error-types above with targeted features. Here’s how it stands out.

a) Fast, accurate billing with automation

- Kenfra BillPad supports barcode scanning, quick item search and one-tap invoice generation.

- Weight-scale integration (Bluetooth/USB/COM) means items sold by weight are captured automatically without manual entry.

- Auto-calculation of taxes, discounts and totals ensures fewer manual math errors.

b) Pricing & discount control safeguards

- Kenfra offers “Price & Discount Guard” allowing you to set maximum discount limits, ensure minimum profit margins, and switch between SP/MRP modes.

- This means staff can’t accidentally (or intentionally) give discounts that bust your margin.

c) Inventory & stock integration

- Every transaction updates inventory in real time. You can see stock, low-stock alerts, branch-wise items.

- Bulk stock & price update feature: upload CSV/Excel to update many products at once, auto-calculate MRP/selling price based on margin.

- Unified platform for offline sales + online orders, meaning one consistent product master and one stock-view.

d) Compliance, tax & professional invoices

- GST-compliant invoicing is built in, e-invoice and e-way bill generation supported.

- Professional invoice templates, easy sharing via WhatsApp or email directly from app.

e) Multi-channel & branch readiness

- Whether you have a single counter or multiple branches, Kenfra BillPad gives you branch-wise performance, centralized reports and online order integration.

- Online orders: customers can choose pickup or home delivery, and all orders are tracked within the same system.

f) Reporting, insights & decision support

- Dashboard provides daily, weekly, monthly sales, GST reports, day-book summaries and branch-wise performance filters.

- With real-time insight, you reduce delays in spotting errors or trends, and you eliminate the “report lag” that manual systems produce.

g) Usability, flexibility & growth-readiness

- Designed for beginners: simple UI, works on mobile/tablet/desktop.

- Scalable: from small single-store setups to multi-branch businesses, so you won’t outgrow it.

Smart automation means you spend less time on billing admin and more on growing your business.

Why the switch to Kenfra BillPad makes business sense?

Time saved = opportunity gained

By reducing manual billing, data entry and correction tasks, your staff can serve more customers, speed up checkout and reduce queues. That improves customer satisfaction and bottom line.

Fewer errors = lower cost

Billing mistakes may seem trivial, but when repeated they add up: wrong prices, missed tax, incorrect stock leads to shrinkage, lost margin, compliance risk. Kenfra mitigates these automatically.

Better decisions = better growth

With real-time data, you can track what’s selling, what’s not, which branch is underperforming, where stock is ageing. This insight empowers smarter purchasing, pricing and marketing.

Professional image = trust & loyalty

Modern branded invoices, digital sharing via WhatsApp/email, error-free billing – all of this builds trust with your customers. Repeat customers matter, and professionalism helps.

Ready for omnichannel & future proofing

With online orders, branch integration, mobile-ready UI and automation built in, you won’t be left behind as retail evolves. Kenfra BillPad gives you that platform.

Final thoughts

If you’re still writing bills manually or using a generic, fragmented system, your business is likely paying for it—in inefficiency, errors, lost margin and slower growth. The shift to Kenfra BillPad offers a clear path: automation, accuracy, professionalism, and modern readiness. You can say goodbye to billing errors and instead say hello to smoother operations, better data and happier customers.

Make the switch, free your staff from the daily billing grind, give your customers a polished experience, and position your business for growth. With Kenfra BillPad, billing isn’t a burden—it’s a strength.

Ready to cut billing errors and move into the digital era? Start with Kenfra BillPad today!