20Feb

Investment Strategies are one of the most effective ways to build long-term wealth and achieve financial security. In today’s fast-changing financial environment, simply saving money is not enough to stay ahead of inflation or meet future financial goals. Smart investment strategies allow individuals to grow their money steadily while managing risks in a disciplined manner, making Investment Strategies essential for long-term success.

This guide explains practical, proven methods to help you invest wisely, avoid common mistakes, and maximize your returns over time.

Many people invest without a clear plan, often influenced by trends or emotions. However, successful investing is about discipline and strategy, not luck.

Smart investment strategies help you:

When you invest with a strategy, you make informed decisions instead of emotional ones.

Before you start investing, it is essential to define your financial goals. Your investment decisions should always align with what you want to achieve in the future.

There are three main types of financial goals:

A clear goal helps you choose the right investment strategy and risk level.

Diversification is one of the most important principles in investing. It means spreading your money across different types of investments to reduce risk.

Instead of investing in just one asset, you can diversify across:

Diversification helps balance your portfolio. If one investment performs poorly, others may perform better and reduce overall losses.

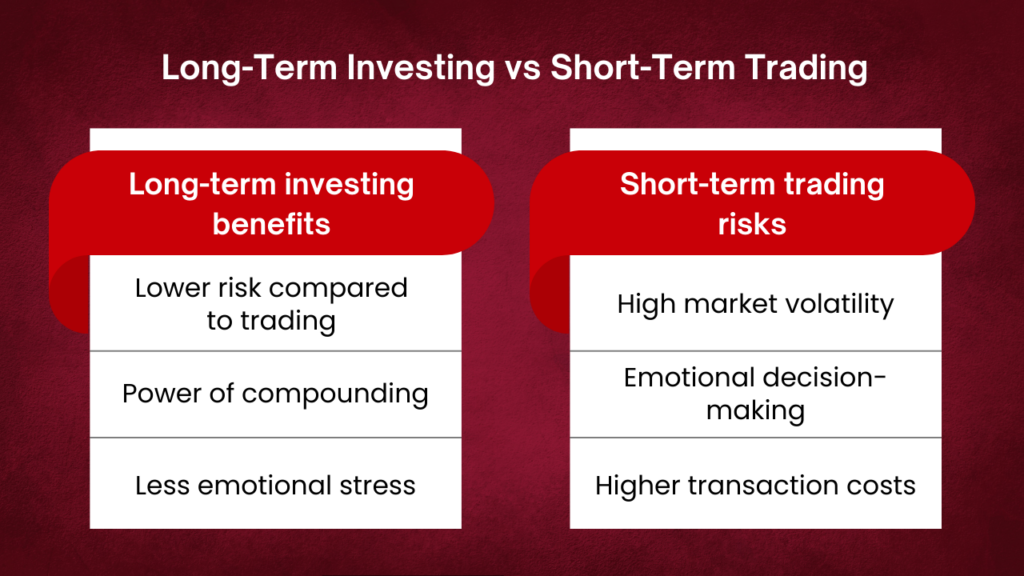

Investors often get confused between long-term investing and short-term trading. While trading may offer quick profits, it comes with high risk and requires constant monitoring.

Long-term investing, on the other hand, focuses on steady growth over time.

For most people, long-term investing is the smarter and safer approach.

Compounding is one of the most powerful concepts in investing. It allows your money to grow exponentially over time by earning returns on both your initial investment and the returns generated.

To maximize compounding:

Even small investments can grow into large amounts if given enough time.

Asset allocation is the process of dividing your investments into different categories based on your risk tolerance and financial goals.

Common asset classes include:

Example allocation strategies:

Choosing the right allocation is key to balancing risk and return.

The stock market offers high return potential, but it requires knowledge and discipline. Instead of following trends blindly, investors should focus on research and long-term growth.

Popular strategies include:

Successful investors avoid emotional decisions and focus on data-driven choices.

Mutual funds and exchange-traded funds are ideal for beginners who want diversification and professional management.

Benefits include:

Systematic Investment Plans (SIPs) allow you to invest small amounts regularly, making investing more accessible.

Risk is an unavoidable part of investing, but it can be controlled with proper strategies. Managing risk helps protect your capital and ensures long-term growth.

Key risk management techniques:

Never invest money that you cannot afford to lose.

Many investors lose money due to avoidable mistakes. These mistakes often come from emotional decisions and lack of planning.

Common mistakes include:

To succeed, it is important to stay disciplined, patient, and focused on long-term goals.

Technology has made investing easier and more accessible. Today, investors can manage their portfolios from anywhere using digital tools.

Popular tools include:

These tools help investors make informed and faster decisions.

Tax planning is an important part of smart investing. Choosing the right investment options can help you save taxes while growing your wealth.

In India, tax-saving options include:

Proper tax planning increases your overall returns.

Consistency is the key to successful investing. Instead of trying to time the market, regular investing helps reduce risk and build wealth steadily.

Best practices:

Small, consistent investments can create significant wealth over time.

For beginners, the best strategy is to start with simple and low-risk options such as mutual funds, SIPs, or index funds. It is important to focus on long-term investing, diversification, and consistency rather than trying to make quick profits.

Kenfra Finstar provides guidance on financial planning, investment strategies, and portfolio management. It helps investors make informed decisions, reduce risks, and choose the right investment options based on their goals.

If you are looking for professional investment guidance in Marthandam, you can connect with Kenfra Finstar for expert advice on financial planning, wealth creation, and smart investment strategies tailored to your needs.

Kenfra branding helps financial and investment businesses build a strong digital presence through strategic marketing, branding, and content creation. This improves visibility, trust, and customer engagement in the competitive financial market.

Yes, diversification is one of the most important principles of investing. It helps reduce risk by spreading investments across different asset classes, ensuring that losses in one area can be balanced by gains in another.

Smart investment strategies are essential for building long-term financial success. By setting clear goals, diversifying your portfolio, managing risks, and staying disciplined, you can maximize your returns.

Investing is not about quick profits but about steady growth and patience. With the right approach, anyone can achieve financial independence. Start your investment journey today with Kenfra Finstar and let your money work for you with expert guidance and smart financial planning.

Saving money is very important for a secure future. But many people find it hard to save regularly. If you... read more

Instant digital receipts are more than just a modern replacement for paper slips. They are smart financial tools that help... read more

Managing money used to feel overwhelming, but finance apps are changing the way we handle our finances. These digital tools... read more

In today’s world, choosing the right finance app is very important. It’s not just about saving time; it helps you... read more

If you are still maintaining records in notebooks or registers, it’s time to rethink. Chit fund management software is changing... read more

Managing loans can feel stressful, especially when you have multiple EMIs, interest rates, and due dates to remember. Many people... read more

As we enter 2026, financial management is undergoing a major transformation. From AI-powered money tools to smarter digital payments, managing... read more

Daily interest on loans are calculated by applying the annual interest rate to the outstanding loan balance each day and... read more

Managing business finances in 2026 can feel overwhelming. With countless transactions, invoices, and ledgers to track, staying organized is often... read more

When you invest your money, you want safety, steady income, and growth. Two common ways money is borrowed in the... read more

WhatsApp us

Leave a Reply