The Future of Digital Billing: Latest Trends to Watch

Kenfra Research - Bavithra2025-11-10T09:32:58+05:30In the latest business landscape, more businesses are shifting to cloud-based billing software, automated payment tracking, and secure online invoicing tools like Kenfra BillPad. These tools simplify the entire billing process, helping companies save time, reduce errors, and improve customer trust. As technology continues to grow, digital billing isn’t just a passing trend, it’s becoming the new normal for modern businesses.

In this article, we’ll explore what digital billing is, why it matters, and the latest trends shaping the future of billing and payment systems.

What Is Digital Billing?

Digital billing is the process of creating, sending, and managing invoices online instead of using traditional paper methods. It allows businesses to automate payment requests, track transactions in real time, and reduce errors that often come with manual billing.

Whether it’s a small online store or a large enterprise, digital billing helps streamline operations, improve cash flow, and deliver a smoother payment experience for both companies and customers.

Why Digital Billing Is the Future?

As businesses continue to shift towards digital transformation, the way we handle billing and payments is evolving fast. Cloud-based billing systems, e-invoicing, and automated payment processing are becoming the new standard for modern finance teams.

These tools not only save time but also enhance accuracy, reduce paper waste, and provide better insights into financial performance.

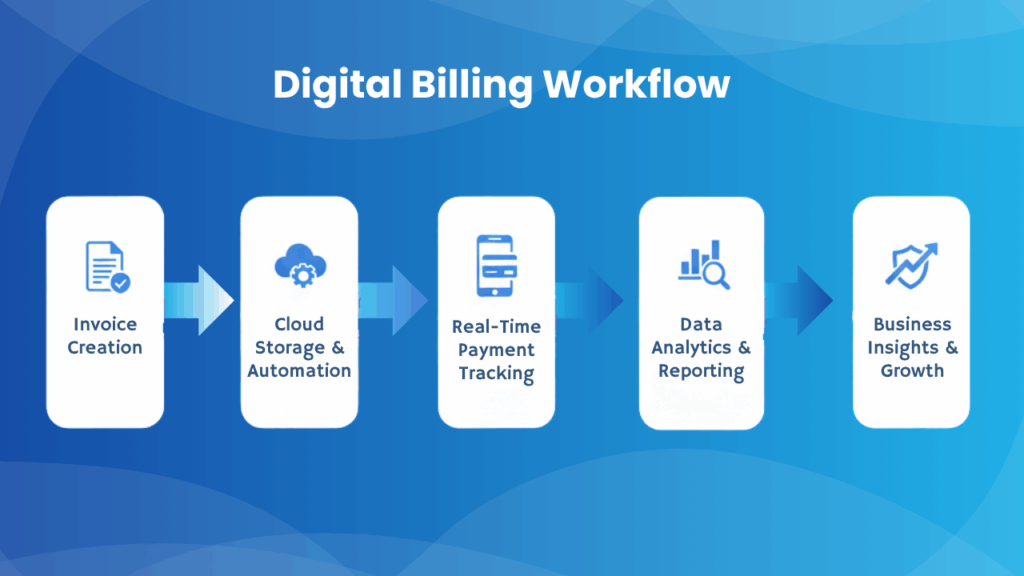

Digital Billing Workflow: How Modern Invoicing Systems Work with the Latest Technology

Understanding how digital billing works helps businesses see why it’s more efficient than traditional methods. Below is a simple workflow that shows the complete digital billing process:

Step 1: Invoice Creation

Businesses generate invoices digitally using tools like Kenfra BillPad, which automatically includes customer details, pricing, and taxes.

Step 2: Cloud Storage & Automation

All invoices are securely stored in the cloud, ensuring easy access anytime, anywhere. Automation handles repetitive tasks like reminders and due date alerts.

Step 3: Real-Time Payment Tracking

Payments are tracked instantly. Businesses can see which invoices are paid, pending, or overdue — without manual follow-ups.

Step 4: Customer Notification & Access

Customers receive their invoices instantly via email, SMS, or WhatsApp and can make payments through integrated gateways in just a few clicks.

Step 5: Data Analytics & Reporting

The system analyzes payment trends, helping companies understand customer behaviour and improve cash flow management.

Step 6: Business Insights & Growth

With real-time data and automated accuracy, businesses save time, reduce errors, and focus more on strategy and customer engagement.

Latest trends in digital billing

Let’s look at what’s happening now and what to watch for in the near future when it comes to digital billing. These are key trends shaping how businesses bill and get paid.

Trend 1: Cloud-based billing and automation

More billing systems are moving into the cloud — meaning they’re accessible from anywhere, updated automatically, easier to maintain. Cloud billing lets a small business access powerful tools without heavy on-site infrastructure.

Automation is another big part: generating invoices automatically, sending reminders for overdue payments, auto-reconciling payments. This reduces manual effort and human error.

Why it matters: Cloud + automation = cost savings, faster billing cycles, less room for mistakes.

Trend 2: AI & machine learning in billing

AI is being used to predict payment behaviour, detect anomalies, personalise billing communications, optimise payment terms.

For example: if a customer historically pays late, the system alerts you or sends a friendly reminder before due date. That kind of proactive approach comes from AI/ML.

Implication: Smarter billing systems can help cash flow, reduce bad debt, and make billing more of a strategic tool rather than just a transactional step.

Trend 3: Subscription, usage-based & flexible billing models

Especially with software, services, IoT, and digital products, businesses are moving away from “one-time invoice” to models like subscriptions (monthly/annual), pay-as-you-go (usage), tiered pricing.

Digital billing systems that handle these models well — generating invoices based on usage, dynamically adjusting pricing, supporting recurring payments — give businesses a competitive edge.

Trend 4: Real-time payments & mobile integration

Customers want convenience — pay now, get confirmation now, on their phone or tablet. Real-time payment systems, mobile billing, digital receipts via SMS/WhatsApp/email are rising.

For example, one system allows sending digital bills via WhatsApp, enabling customers to pay from there.

Takeaway: Make it easy for the customer. The easier you make paying, the fewer delays and hassles you face.

Trend 5: Blockchain, smart contracts & security

Security, trust and transparency are crucial in billing. Using technologies like blockchain and smart contracts means invoices can be recorded immutably, payments triggered automatically when certain conditions are met, less risk of manipulation.

Especially for B2B or international transactions, where trust and audit trails matter, this is a strong trend.

Trend 6: Better compliance, data standards & interoperability

Billing and invoicing systems must integrate with tax rules, regulations, reporting requirements. Also, being interoperable — connecting with accounting software, ERP, payment gateways — is becoming must-have.

This means that a digital billing system isn’t just isolated — it’s part of your overall business ecosystem.

Trend 7: Enhanced customer experience & engagement

Digital bills are also becoming a channel for engagement — personalised messages, offers, loyalty programmes, integrated feedback, digital receipts that carry marketing value. For example: sending digital invoices that also encourage reviews, loyalty sign‐ups.

Billing becomes more than a cost collection step — it’s an engagement touchpoint.

Conclusion

Digital billing is no longer just a “nice to have”, it has become a business necessity. With speed, efficiency, cost savings, better customer experience, and flexible pricing models, digital billing helps businesses stay competitive in a fast-changing market.

Looking ahead, trends like cloud-based billing, AI/ML automation, mobile and real-time payments, blockchain security, and deeper system integration will define how companies bill, get paid, and engage with customers.

Apps like Kenfra BillPad make this transition simple and efficient. With features such as cloud-based invoicing, real-time tracking, automated reminders, and GST-ready templates, Kenfra helps businesses modernize their billing without complexity.

Leave a Reply