Top 5 Billing Software Features That Will Dominate in 2026

Kenfra Research - Bavithra2025-11-03T17:31:54+05:30In today’s fast-changing business landscape, having the right billing software is more than just sending invoices and tracking payments. As we move toward 2026, businesses of all sizes are looking for smarter, faster, more flexible billing solutions that help them stay ahead. In this blog, we’ll explore five key billing software features that will dominate in 2026.

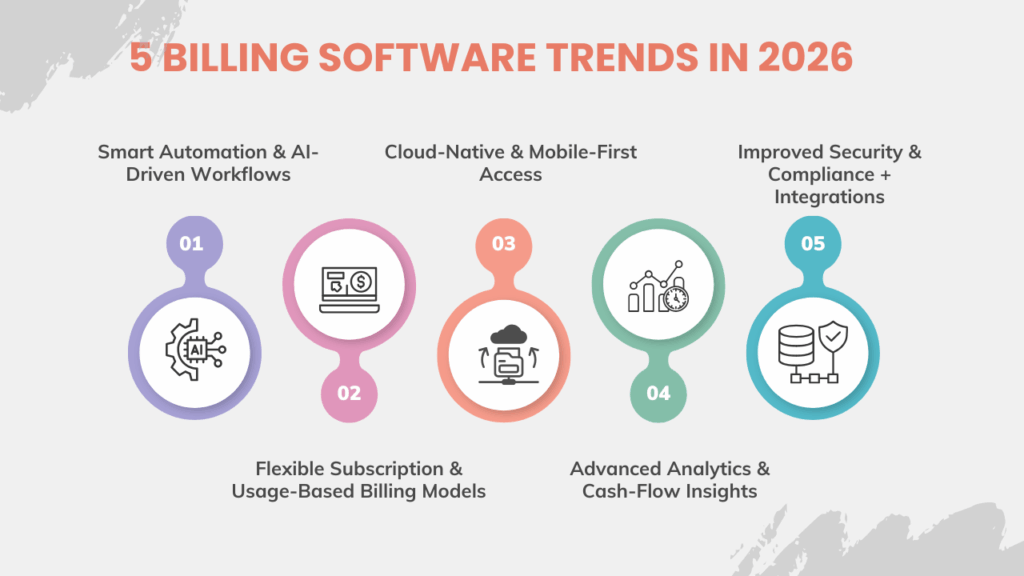

5 Billing Software Trends in 2026

1. Smart Automation & AI-Driven Workflows

One of the biggest shifts you’ll see is billing software that thinks for you. Rather than manual work, you’ll have systems that automate and optimise.

Why it matters?

- Automation reduces errors, speeds up tasks, and frees your team for more strategic work.

- AI and machine learning are increasingly built into billing platforms to forecast revenue, detect anomalies, and optimise payment cycles.

What to look for?

- Use case: A billing system that automatically sends invoices, triggers reminders, escalates overdue payments, and updates your accounting system.

- Smart features like predicting which customers are likely to pay late, or identifying pricing mistakes before they hit your cash flow.

- Integration with your CRM, accounting, and payment gateways so the workflow is seamless.

Why this will dominate in 2026?

As businesses push to cut costs and improve accuracy, automation and AI in billing become non-negotiable. The competitive edge will come from how your software helps you manage billing with less effort and more intelligence.

2. Flexible Subscription & Usage-Based Billing Models

The business world is shifting from one-time payments to subscriptions, from flat fees to usage-based pricing. Your billing software must reflect that.

Why it matters?

- Customers expect flexibility. Businesses offer subscription tiers, pay-as-you-go models, or usage-based fees.

- Traditional billing (single invoice, fixed amount) won’t cut it for many growth-oriented companies.

What to look for?

- Ability to configure different billing models: recurring subscriptions, metered usage, add-ons, discounts.

- Automated renewal notifications, pricing changes, cancellation handling.

- Analytics that help you see which model works best for your business.

Why this will dominate in 2026?

As more businesses embrace the as-a-service economy, billing systems must adapt. The winners will offer greater flexibility — giving companies the power to scale, iterate, and pivot pricing models.

3. Cloud-Native & Mobile-First Access

Billing isn’t just back-office work anymore. With remote teams, mobile devices and real-time access, billing software needs to live in the cloud and be mobile friendly.

Why it matters?

- Cloud-based billing software gives you accessibility from anywhere, anytime.

- Mobile interfaces let you create invoices, approve payments or see reports on the go.

What to look for?

- Software hosted in the cloud with web and mobile apps.

- Responsive design so you can work from laptop, tablet or phone.

- Real-time updates: when a customer pays online, your dashboard updates instantly.

Why this will dominate in 2026?

Teams and working from home are here to stay. You’ll need billing tools that keep up with that pace. The ability to manage billing while away from your desk is now a requirement, not a “nice to have”.

4. Advanced Analytics & Cash-Flow Insights

Billing is not just invoicing. It’s also a window into your cash flow, business health and customer behaviour. The best billing software gives you deep insights.

Why it matters?

- Analytics help you understand when payments are likely, which clients delay, what your outstanding receivables look like.

- Having this data means you can act proactively — chase payments, offer incentives, adjust pricing.

What to look for?

- Dashboards showing key performance indicators (KPIs) like days‐sales‐outstanding, aging invoices, payment trends.

- Predictive insights: which customers pose a risk, upcoming revenue forecasting.

- Reports you can customise and export easily for stakeholders.

Why this will dominate in 2026?

Businesses will no longer tolerate billing tools that simply generate invoices. They’ll demand software that gives strategic value. Analytics are the differentiator.

5. Improved Security & Compliance + Integrations

Last but not least: security, compliance and seamless integrations. As billing becomes more digital and global, you need to trust your tools and connect them to your ecosystem.

Why it matters?

- Billing systems handle sensitive data: payment details, customer info, tax information. Security breaches cost money and reputation.

- Compliance with tax rules, local regulations, global standards is complex but essential.

- Integration with payment gateways, accounting software, CRMs is no longer optional — it’s expected.

What to look for?

- Strong encryption, two-factor authentication, audit logs.

- Support for tax compliance (GST, VAT, e-invoices) depending on your jurisdiction.

- Built-in or easy connectors for third-party systems: Stripe, PayPal, QuickBooks, Xero, CRMs.

- Ability to adapt as regulations evolve.

Why this will dominate in 2026?

With cyber-risks rising and regulatory frameworks tightening, billing software that lags in security or integration becomes a liability. Businesses will adopt systems that are trustworthy, compliant and connected.

Quick Recap: Must-Have Features Every Billing Software Will Need in 2026

Here’s a quick recap of the five dominating billing software features for 2026:

Conclusion

If you’re choosing or upgrading billing software now, aim for a system that does more than send invoices. In 2026 and beyond, you’ll want software that automates intelligently, supports diverse billing models, offers access everywhere, gives you strategic insights, and safeguards your data. By focusing on these five dominating features — automation/AI, subscription/usage billing, cloud/mobile access, analytics, and security/integration — you’ll be ready for the future of billing.

Power your business with Kenfra BillPad, India’s smartest billing platform by Kenfra, designed for financial services, businesses, agencies, and more.

FAQs: Billing Software Features That Will Dominate in 2026

- How will AI automation change billing software in 2026?

AI will handle repetitive billing tasks automatically, saving time and reducing errors. It can also predict late payments and send reminders.

- How does flexible subscription and usage-based billing benefit businesses?

It helps businesses offer customers different payment options like monthly plans or pay-per-use, improving satisfaction and sales.

- How will cloud-native and mobile-first billing software improve accessibility?

You can access billing data anytime and anywhere through the cloud or mobile apps, making work easier for remote teams.

- Why are analytics and cash-flow insights crucial for modern billing systems?

They show where your money comes and goes, helping you plan better and avoid payment delays.

- How can enhanced security and compliance protect businesses?

Stronger security keeps customer and payment data safe, while compliance helps avoid legal and tax issues.