Why Automated Billing Systems Are Becoming Essential in 2026?

Kenfra Research - Bavithra2026-02-04T17:10:51+05:30In 2026, businesses are moving faster than ever. Customers expect quick service, accurate bills, flexible payment options, and zero errors. At the same time, companies are handling more subscriptions, recurring payments, global customers, and complex pricing models. This is where automated billing systems in 2026 are no longer optional—they are essential. An automated billing system helps businesses manage invoicing, payments, subscriptions, taxes, and renewals automatically, with little to no manual work. In this blog, we’ll explore why automated billing systems are becoming essential in 2026, how they help businesses grow, and why manual billing is slowly disappearing.

What Is an Automated Billing System?

An automated billing system is software that handles billing and payment processes automatically. Instead of creating invoices manually or tracking payments in spreadsheets, the system does everything for you. It can:

- Generate invoices automatically

- Process recurring payments

- Handle subscriptions and usage-based billing

- Apply taxes and discounts

- Send payment reminders

- Reduce billing errors

- Integrate with accounting and CRM tools

In simple terms, it saves time, reduces mistakes, and ensures businesses get paid on time.

Why Manual Billing Is No Longer Enough in 2026?

Manual billing worked in the past when businesses were small and transactions were limited. But in 2026, things are different.

Here’s why manual billing is failing:

- Too many transactions to track

- High risk of human errors

- Delayed invoices and payments

- Poor customer experience

- No real-time billing insights

- Difficult to scale

With digital payments, subscriptions, and global customers becoming the norm, businesses need smarter billing solutions.

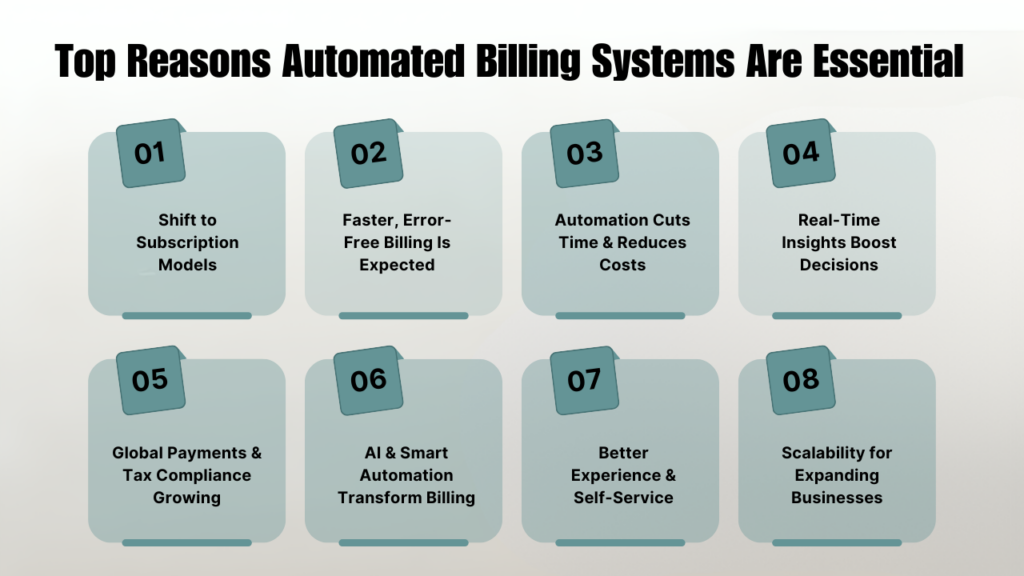

1. Businesses Are Moving to Subscription and Recurring Models

One of the biggest reasons automated billing systems are essential in 2026 is the rise of subscription-based business models.

Industries using subscriptions include:

- SaaS companies

- Streaming platforms

- E-learning platforms

- Fitness and wellness apps

- Membership websites

- B2B service providers

Managing recurring payments manually is nearly impossible at scale.

Automated billing systems in 2026 handle:

- Monthly or yearly subscriptions

- Auto-renewals

- Plan upgrades and downgrades

- Prorated charges

This makes them critical for modern businesses.

2. Customers Expect Faster and Error-Free Billing

In 2026, customer patience is very low. A small billing mistakes can lead to:

- Customer complaints

- Payment delays

- Loss of trust

- Negative reviews

An automated billing system reduces human errors and ensures:

- Accurate invoices

- Clear billing details

- On-time payments

When customers receive correct bills every time, their trust in the brand increases.

3. Automation Saves Time and Reduces Costs

Manual billing takes hours of work every week. Teams spend time:

- Creating invoices

- Checking payment status

- Sending reminders

- Fixing errors

Automated billing systems handle all of this automatically.

Key benefits include:

- Lower operational costs

- Less dependency on large billing teams

- More time for strategic tasks

- Faster billing cycles

In 2026, saving time means saving money—and automation makes that possible.

4. Real-Time Billing Insights Improve Decision-Making

Modern businesses need data to grow. Automated billing systems provide real-time insights, such as:

- Monthly recurring revenue (MRR)

- Payment success and failure rates

- Customer churn

- Revenue forecasts

These insights help business owners:

- Make better financial decisions

- Improve pricing strategies

- Identify payment issues early

Manual billing simply cannot offer this level of visibility.

5. Global Payments and Tax Compliance Are More Complex

As businesses expand globally, billing becomes more complicated. Companies now deal with:

- Multiple currencies

- Different tax rules

- Local compliance laws

Automated billing systems help manage:

- Currency conversion

- Regional tax calculations

- GST, VAT, and sales tax

- Country-specific invoicing rules

In 2026, compliance errors can lead to heavy fines. Automation reduces these risks significantly.

6. AI and Smart Automation Are Changing Billing

Automated billing systems in 2026 are smarter than ever. Many platforms now use AI-powered billing automation.

AI helps by:

- Predicting payment failures

- Reducing involuntary churn

- Optimizing payment retries

- Detecting billing anomalies

This smart automation ensures higher payment success rates and smoother cash flow.

7. Better Customer Experience and Self-Service Options

Customer experience is a major competitive advantage in 2026.

Automated billing systems offer:

- Customer billing portals

- Self-service payment options

- Downloadable invoices

- Payment method updates

Customers prefer controlling their billing without contacting support. This improves satisfaction and reduces support workload.

8. Scalability for Growing Businesses

As businesses grow, billing complexity increases. Automated billing systems scale easily with growth.

They support:

- More customers

- Higher transaction volumes

- New pricing models

- Multiple products and plans

Whether a business has 100 or 1 million customers, automation ensures smooth billing operations.

Key Features to Look for in an Automated Billing System in 2026

If you’re choosing a billing solution, look for these essential features:

- Recurring and subscription billing

- Usage-based and tiered pricing

- Automated invoicing and reminders

- Multiple payment gateways

- Tax and compliance management

- Real-time analytics and reports

- Secure payment processing

- Easy integration with accounting software

These features ensure long-term success and flexibility.

Industries That Benefit the Most from Automated Billing Systems

In 2026, almost every industry benefits from automated billing, especially:

- SaaS and software companies

- Healthcare and telemedicine

- Education and e-learning platforms

- Media and streaming services

- Utilities and telecom providers

- Freelancers and agencies

Any business with repeat customers or ongoing services needs billing automation.

Is an Automated Billing System Worth It for Small Businesses?

Yes, absolutely.

Even small businesses benefit from:

- Fewer billing errors

- Faster payments

- Better cash flow

- Professional invoicing

Many modern billing tools are affordable and designed for startups and SMEs.

FAQs About Automated Billing Systems

1. What is the main purpose of an automated billing system?

The main purpose is to automate invoicing, payments, and billing management, reducing manual work and errors.

2. Are automated billing systems secure?

Yes, most systems use encryption, secure payment gateways, and compliance standards to protect customer data.

3. Do automated billing systems support multiple payment methods?

Most systems like Kenfra BillPad supports credit cards, debit cards, bank transfers, and digital wallets.

4. Can automated billing handle failed payments?

Yes, modern systems automatically retry payments and notify customers to reduce revenue loss.

Final Thoughts

In 2026, automated billing systems are no longer a luxury—they are a necessity. Businesses that rely on manual billing struggle with errors, delays, and unhappy custsomers, while those that adopt automation enjoy faster payments, better insights, and improved customer experiences.

As technology advances and customer expectations rise, automated billing becomes the backbone of modern business operations. Many businesses are turning to modern billing platforms such as Kenfra BillPad to simplify invoicing, automate recurring payments, and gain better control over their billing workflows. Investing in the right billing system today prepares businesses for long-term growth, scalability, and success. If your business wants to stay competitive in 2026 and beyond, now is the time to embrace automated billing.

Leave a Reply