Bonds vs Loans: What’s the Difference for Investors?

Kenfra Research - Bavithra2026-02-06T17:14:33+05:30When you invest your money, you want safety, steady income, and growth. Two common ways money is borrowed in the financial world are bonds and loans. The main difference between bonds and loans for investors is how the money is lent, traded, and earned. Many investors hear these words but feel confused. This blog explains bonds vs loans in simple words. You will learn what they are, how they work, and which one may be better for investors.

What Is a Bond in Finance?

A bond is a financial instrument where an investor lends money to a government, company, or institution. In return, the issuer promises to pay interest at a fixed rate and return the principal amount when the bond matures.

Bonds are usually issued to raise large amounts of money for:

- Infrastructure projects – like roads, bridges, and public utilities

- Business expansion – funding growth or new ventures

- Public projects – social or government initiatives

Unlike loans, bonds are traded in financial markets and are regulated by authorities such as SEBI in India. This makes them more transparent and safer for investors seeking steady income.

What Are Loans?

A loan is money provided by a bank, financial institution, or lender to a borrower, who agrees to repay the amount along with interest over a set period. Unlike bonds, loans are private agreements and are usually not traded in the market.

Loans are commonly used by:

- Individuals – for personal needs, education, or home loans

- Small businesses – to fund operations, inventory, or expansion

- Large companies – for working capital or business projects

Loans allow borrowers to access money quickly, while investors or lenders earn interest income. The returns from loans are often higher than bonds, but they also carry higher risk, especially if the borrower cannot repay.

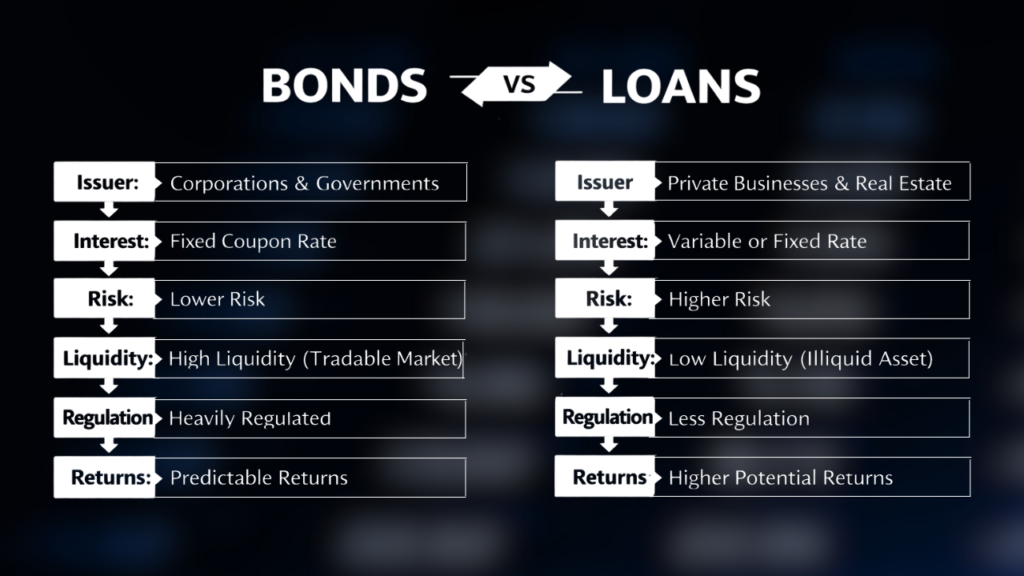

Bonds vs Loans: Quick Comparison

Feature | Bonds | Loans |

Issuer | Government, companies | Individuals or businesses |

Interest | Fixed or floating | Usually fixed |

Risk | Low to medium | Medium to high |

Liquidity | Can be traded | Usually locked in |

Regulation | Highly regulated | Less regulated |

Returns | Stable | Potentially higher |

How Do Bonds Work for Investors?

Bonds are popular among investors who want safe and predictable returns. When you invest in a bond, you are basically lending your money to a government or a company. In return, the issuer agrees to pay you regular interest and return your original amount after a fixed period.

Bonds work on three main components:

- Principal Amount – The money you invest in the bond

- Interest (Coupon Rate) – The fixed return you earn on your investment

- Maturity Period – The time after which you get your money back

For example, if you buy a bond worth ₹10,000 with an interest rate of 8% for 5 years, you will receive ₹800 every year. After 5 years, you will also get back your ₹10,000.

Benefits of Investing in Bonds:

- Lower risk compared to stocks

- Regular income

- Suitable for long-term financial planning

- Ideal for retirees and conservative investors

How Do Loans Work for Investors?

Loan-based investments allow investors to earn higher interest by directly lending money to individuals or businesses. In this type of investment, the investor acts as the lender, while the borrower agrees to repay the loan amount along with interest over a fixed period.

When you invest in loans, your returns mainly depend on three factors:

- Loan Amount – The money you lend

- Interest Rate – The return you earn on the loan

- Repayment Period – The time frame in which the borrower repays the loan

For example, if you lend ₹1,00,000 at an interest rate of 12% for one year, you will earn ₹12,000 as interest by the end of the loan term.

Types of Loan Investments:

- Personal loans

- Business loans

- P2P lending

- Corporate debt lending

Benefits of Loan Investments:

- Higher returns than bonds

- Shorter investment duration

- Flexible investment amount

Bonds vs Loans: Which Gives Better Returns?

- Bonds usually offer 6%–9% returns

- Loans can offer 10%–18% returns

Higher returns always come with higher risk. Conservative investors prefer bonds, while aggressive investors may choose loan investments.

Frequently Asked Questions

1. What is the main difference between bonds and loans?

Bonds are tradable debt instruments issued by institutions, while loans are direct money-lending agreements between lenders and borrowers. Bonds can be sold before maturity, but loans are usually fixed until repayment.

2. Can I invest in loans using Kenfra Finstar?

Yes, Kenfra Finstar one of the best finance applications in India allows investors to easily invest in loan-based instruments through a secure and user-friendly platform.

3. Are bonds better than loans for investors?

Bonds are generally safer and regulated, providing steady income, while loans can offer higher returns but carry greater risk, especially if the borrower defaults.

4. Can individuals invest in bonds?

Yes, individuals can invest in government and corporate bonds easily through online platforms or financial apps, making it accessible for both beginners and experienced investors.

5. Are loan investments risky?

Yes, loan investments carry a higher risk, particularly unsecured loans, because repayment depends entirely on the borrower’s ability to pay on time.

6. Which is better for passive income: bonds or loans?

Bonds are ideal for passive income as they provide predictable and regular interest payments, making them safer for long-term financial planning.

Final Thoughts: Bonds vs Loans

Both bonds and loans have their place in an investment portfolio. Bonds provide safety and stability, making them ideal for conservative investors or those new to investing. On the other hand, loans can offer higher returns, but they come with higher risk and require careful monitoring. The right choice depends on your financial goals, risk appetite, and investment horizon.

To manage and track your investments effectively, using a reliable finance platform is essential. Platforms like Kenfra Finstar, recognized as one of the best finance applications in India, make it easier to invest in bonds, loans, and other financial instruments with transparency and convenience.

Leave a Reply