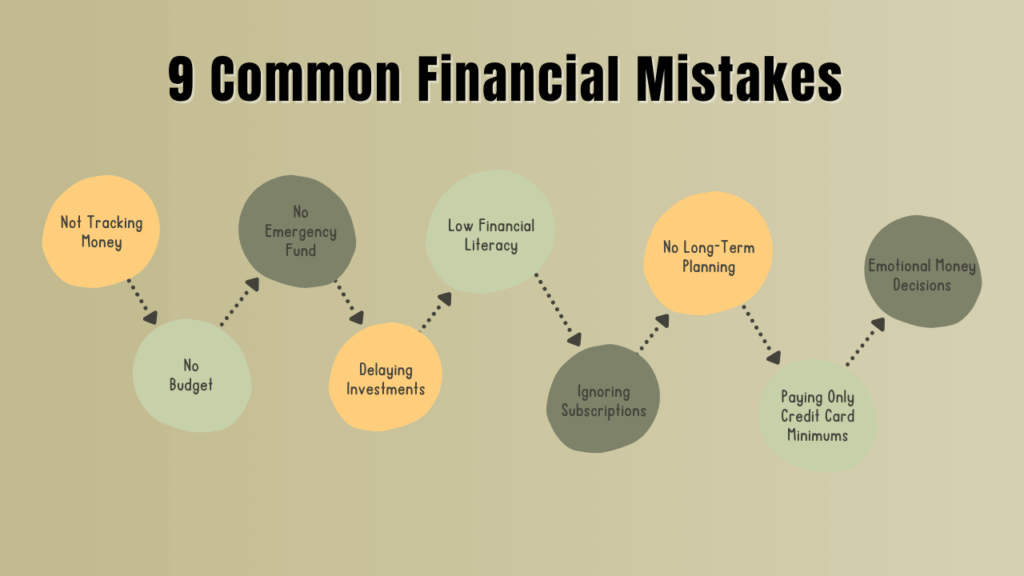

Stop Losing Money: 9 Costly Financial Mistakes Almost Everyone Still Makes in 2025

Kenfra Research - Bavithra2025-11-28T16:57:12+05:30Many people don’t realize how much money they quietly lose every month because of common financial mistakes. These errors seem small at first like skipping budgeting or ignoring your credit score but over time, they drain savings, increase debt, and create long-term money stress. The good news? Once you understand these mistakes, you can fix them fast and improve your personal finance life in a big way.

Below are the 9 most costly financial mistakes people still make in 2025, along with simple ways to avoid them.

9 Common Financial Mistakes and How to Fix Them

1. Not Tracking Where Your Money Actually Goes

One of the biggest financial mistakes is not knowing your monthly spending pattern. Overspending doesn’t always look like shopping sprees—it’s usually small daily costs that stack up.

Many people guess their expenses instead of tracking them properly. This leads to:

- Missing small leaks like subscriptions

- Underestimating groceries or transportation

- Feeling broke even with a decent income

Fix:

Use a simple money management or budget app to track everything automatically. Once you see the numbers clearly, better decisions come naturally.

2. Living Without a Budget

Budgeting is not about limiting yourself—it’s about making your money work for you.

But in 2025, most people still skip budgeting completely.

A budget helps you control over spending habits, plan savings goals, and build a clear financial roadmap.

Fix:

Follow a basic method like the 50/30/20 rule:

- 50% needs

- 30% wants

- 20% savings or debt repayment

Even a simple weekly review improves personal finance health.

3. Ignoring Emergency Savings

Life is unpredictable. Losing a job, a medical bill, or a sudden repair can appear at any time.

Yet many people still don’t have even one month of emergency savings—one of the riskiest personal finance mistakes.

Fix:

Start small. Even saving ₹1,000 or $20 per week builds a buffer. Aim for:

- 3 months of essential expenses (minimum)

- 6 months if you have dependents

This one habit protects you from debt traps.

4. Paying Only the Minimum on Credit Cards

Credit card minimum payments look easy, but they’re a financial trap. If you only pay the minimum:

- Your interest grows

- Your debt lasts longer

- You end up paying double or triple the original amount

This is one of the most expensive money mistakes people make.

Fix:

Pay more than the minimum every month, even if it’s small. If possible, shift high-interest debt to a lower-interest loan or repayment plan.

5. Not Investing Early

Investing is no longer optional—it’s necessary. Yet many people delay investing because they believe they need a lot of money.

The truth?

Even small amounts grow through compounding. Waiting just 5–10 years can cost you lakhs or thousands in long-term returns.

Fix:

Start with easy options like index funds, SIPs, retirement accounts, or robo-advisor portfolios, and set automatic monthly investments so time and compounding can do the work.

6. Making Emotional Financial Decisions

Emotions ruin good financial planning. Common emotional mistakes include panic selling during market dips, overspending to feel better, buying things to impress others, and giving in to the fear of missing out on risky investments.

Fix:

Think long-term. Before any big purchase or investment, wait 24 hours and ask: “Do I really need this, or is it just emotion?”

7. Not Reviewing Subscriptions and Monthly Charges

Many people forget what they’re paying for—streaming apps, gym memberships, software trials, food delivery memberships, etc. These small costs create invisible budgeting mistakes.

Fix:

Once a month, review all auto-payments, cancel anything unused, and switch to cheaper alternatives—this alone can save hundreds or even thousands per year.

8. Not Learning Basic Personal Finance

School never taught most of us money skills. But in 2025, lack of financial literacy is still one of the most damaging financial mistakes. If you don’t understand money, you can’t manage it well.

Fix:

Learn basic concepts:

- How interest works

- How to build credit

- How taxes affect income

- Difference between assets and liabilities

- Why long-term investing beats short-term trading

Even one hour a week of learning can change your life.

9. Not Thinking About Long-Term Goals

Many people plan for the next month but not the next 10 years. Without long-term goals, money gets spent randomly.

Fix:

Create simple long-term financial plans for goals such as buying a home, saving for retirement, funding your kids’ education, building wealth, or starting a business. Set monthly steps toward these goals. Small actions add up over time.

How to Avoid These Financial Mistakes in 2025?

You don’t need complicated financial plans. Just build a few solid habits:

- Track your expenses

- Create a simple budget

- Build an emergency fund

- Pay off high-interest debt

- Start investing early

- Review unnecessary spending

- Keep learning about personal finance

Consistency beats perfection.

Frequently Asked Questions (FAQs)

1. What is the biggest financial mistake people make today?

The most common financial mistake is not tracking expenses. When you don’t know where your money goes, you can’t control your financial life.

2. How do I start budgeting if I’m a beginner?

Start with a simple method like 50/30/20, or use a budget app to auto-track income and expenses.

3. How much emergency savings should I have?

Aim for 3–6 months of essential expenses. Start small and build slowly.

4. Is investing risky for beginners?

Investing is only risky when done without knowledge. Long-term options like index funds are generally safer and great for beginners.

5. How can I stop overspending?

Track spending, set limits, reduce impulsive purchases, and avoid emotional spending triggers.

Conclusion

Avoiding these nine common financial mistakes can transform your money life in 2025. Small daily improvements budgeting, tracking expenses, investing early, and staying consistent are the real secrets to growing wealth.

If you want an easier way to track spending, plan budgets, and manage your finances, Kenfra FinStar offers a best finance app in India with a free trial to help you take control of your financial future.

Leave a Reply