Financial Management Trends Everyone Should Know in 2026

Kenfra Research - Bavithra2025-11-24T14:39:59+05:30As we enter 2026, financial management is undergoing a major transformation. From AI-powered money tools to smarter digital payments, managing your finances has never been easier — or more automated. Whether you’re a student, a professional, or a business owner, understanding these key trends will help you stay ahead of the curve in today’s fast-evolving economic environment.

In this article, we’ll break down the most important financial management trends for 2026. These trends will reshape how we spend, save, invest, and plan for the future. Let’s dive into the world of digital finance!

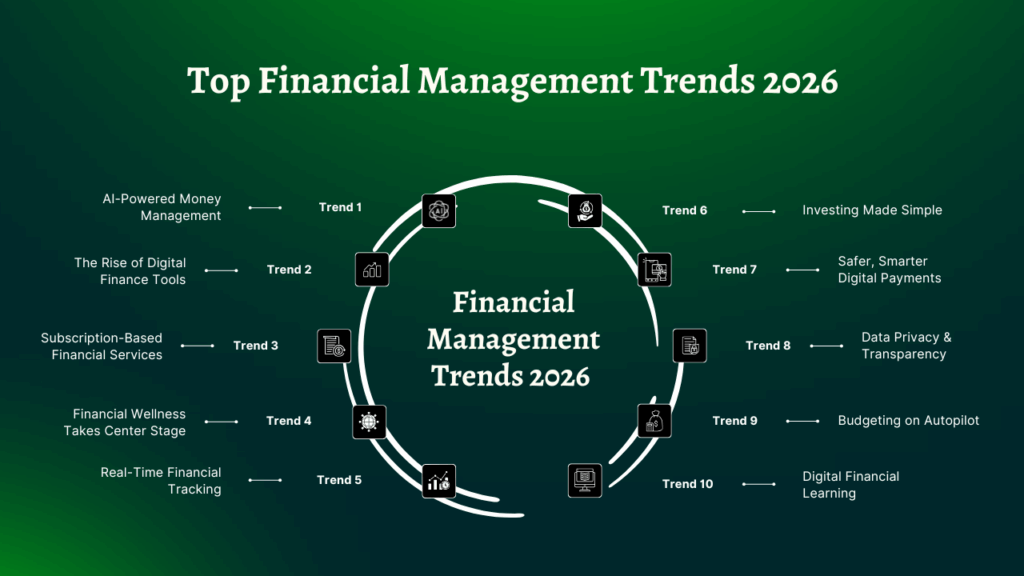

Top Financial Management Trends 2026 You Must Know

1. AI-Powered Money Management

AI is transforming the way we manage money. In 2026, smart finance apps will do more than track your spending—they’ll anticipate it. AI tools analyze your spending patterns, predict cash flow, and offer personalized suggestions for saving. For instance, your app might automatically move small amounts into savings or alert you when you’re at risk of overspending. This personalized guidance means managing money will feel easier and more intuitive than ever.

Key Benefit:

AI-driven tools help even beginners save money effortlessly, making financial planning simpler and more effective.

2. The Rise of Digital Finance Tools

Digital finance is now mainstream. Mobile wallets, online banking, and cloud-based platforms are replacing traditional banking, offering seamless access to all your financial needs. Whether it’s checking account balances or transferring funds, managing money through digital tools has become second nature. Real-time financial tracking means you’re always in control.

Key Benefit:

Access to instant updates and effortless control over your finances—no more waiting for monthly statements.

3. Subscription-Based Financial Services

Subscription models are expanding into the financial sector. Instead of paying a lump sum upfront for services like investment advice or credit monitoring, you can now subscribe to these services for a low monthly fee. This democratizes access to premium financial tools, allowing more people to benefit from expert resources without breaking the bank.

Key Benefit:

Affordable access to advanced financial tools, from tax planning to smarter payment options, on a budget-friendly subscription basis.

4. Financial Wellness Takes Center Stage

In 2026, personal financial wellness is a major priority. It’s no longer just about saving money or paying bills—it’s about building a holistic financial plan that supports long-term health. This includes building emergency funds, reducing debt, and planning for retirement. Many companies are also offering financial wellness benefits, helping employees reduce stress and build healthier financial habits.

Key Benefit:

Financial wellness initiatives are reshaping how we think about money, with a focus on reducing stress and improving overall well-being.

5. Real-Time Financial Tracking

Waiting for monthly statements is a thing of the past. In 2026, real-time financial tracking is standard. Apps now send instant notifications when you spend, categorize transactions automatically, and give you up-to-the-minute visibility into your financial status. This helps you avoid surprise expenses and stay on top of your budget with ease.

Key Benefit:

Instant tracking helps you stick to your budget and avoid overspending by offering real-time insight into your financial activity.

6. Investing Made Simple

Investing has never been easier. Platforms in 2026 offer micro-investing features, allowing you to start investing with just a few dollars. AI-powered robo-advisors build low-risk, goal-based portfolios, taking the guesswork out of investing. These tools explain performance in simple charts, making investing feel like a natural part of your money management routine.

Key Benefit:

Accessible investing for beginners, with no large sums required to start building wealth.

7. Safer, Smarter Digital Payments

Digital payments are evolving. In 2026, biometric security (fingerprints or facial recognition) and advanced encryption ensure your transactions are safer than ever. Whether you’re making online purchases or transferring funds, digital payment systems are faster, smarter, and more secure, with fraud detection working behind the scenes.

Key Benefit:

Enhanced security with fast, easy payments and peace of mind with zero-trust models.

8. Data Privacy & Transparency

With the rise of digital finance, data privacy is more important than ever. In 2026, financial platforms are committed to transparency, giving you clear insights into how your data is stored, shared, and used. You’ll have control over your information, ensuring privacy is prioritized.

Key Benefit:

More control over your personal financial data, building trust with platforms that prioritize privacy.

9. Budgeting on Autopilot

One of the most practical trends in 2026 is automated budgeting. Smart tools categorize your spending, sweep money into savings, and alert you when you’re nearing your limits—all automatically. This makes budgeting feel effortless, ensuring you’re always on track without the stress.

Key Benefit:

A completely automated budgeting experience, reducing the hassle of managing day-to-day expenses.

10. Digital Financial Learning

Gone are the days of dense textbooks and long seminars. In 2026, financial education is bite-sized, accessible, and engaging. From short videos to interactive apps, you can now learn about credit, investing, and budgeting in your own time—making financial literacy accessible for everyone.

Key Benefit:

Learn personal finance skills quickly through engaging digital content and feel more confident about your financial decisions.

11. Embedded Finance Everywhere

Embedded finance is changing the game. In 2026, financial services like loans, payments, and insurance are integrated directly into everyday apps—like booking a flight or buying an item online. Thanks to APIs and open banking, financial services are no longer confined to banks—they’re woven seamlessly into the platforms we use daily.

Key Benefit:

Access to financial services is now more convenient, with fewer barriers between you and the tools you need.

12. AI for Compliance and Security (RegTech)

AI is also making financial regulation smarter. In 2026, many financial institutions are using AI-powered regulatory technology (RegTech) to monitor transactions, detect fraud, and automate compliance tasks. This helps spot suspicious behavior and reduce risks with greater efficiency than ever before.

Key Benefit:

Faster, more effective fraud detection and risk management, protecting your finances at all times.

13. Tokenized Assets & Digital Currencies

In 2026, tokenized assets—such as real estate, art, or bonds—are becoming more common. These assets are converted into blockchain-based tokens, making them easily tradable. Additionally, Central Bank Digital Currencies (CBDCs) are gaining traction, offering more secure and efficient ways to manage digital transactions.

Key Benefit:

Tokenized assets and digital currencies create a more liquid, accessible, and modular investment landscape.

Conclusion: Embrace the Future of Finance

As we move into 2026, financial management is no longer just about tracking expenses or balancing a checkbook. With AI tools, real-time tracking, and safer digital payments, managing your finances is smarter, easier, and more personalized than ever before. These trends are reshaping how we think about money—and if you want to experience them firsthand, try Kenfra Finstar, the trusted finance app. It offers a free trial to explore AI budgeting, automated investing, and much more—risk-free.

FAQs

1. What are the key financial trends for 2026?

AI tools, digital banking, real-time tracking, automated budgeting, better data security, and beginner-friendly investing.

2. Why should I follow new financial trends?

It helps you save, budget, and invest more easily and effectively.

3. Are digital finance tools safe in 2026?

Yes, they use advanced security like encryption and biometric login.

4. How does automated budgeting help?

It tracks expenses, builds savings, prevents overspending, and makes goal-setting simple.

5. Is investing hard for beginners in 2026?

No, many platforms offer easy guides, automated suggestions, and small investment options.

Leave a Reply