Is Your Finance App Really Helping You? Here’s What to Look For!

Kenfra Research - Bavithra2025-11-28T14:20:31+05:30Most of us download a finance app hoping it will make money management easier. We want something that helps us track expenses, plan our budget, and understand where our money goes every month. But the truth is, not every finance app does a good job. Some apps look fancy but don’t actually help you build better habits. Others are so confusing that you stop using them after a few days.

So how do you know if your finance app is truly helping you? This guide explains what features matter, how to check your app’s performance, and how to get the most value out of it. Everything is written in simple, everyday words so you can easily understand what to look for.

How to Evaluate Your Finance App’s Performance?

Now that you know what features to look for, the next step is understanding whether your current finance app is actually working for you. Here are simple ways to evaluate its performance.

1. Does It Help You Stay Organized?

If your app brings clarity to your finances and helps you stay organized, it’s likely doing its job well. You should feel more aware not more confused after using it.

2. Does It Save You Time?

A good finance app saves you time. Adding expenses, checking your budget, and tracking progress should only take a few seconds. If the app feels slow, messy, or complicated, it’s not helping you efficiently.

3. Are You More Aware of Your Spending Habits?

One of the biggest signs that your app is useful is when you start noticing changes in your spending habits. Maybe you’ve realized you spend too much on snacks or online shopping—that awareness is progress.

4. Are You Actually Reaching Your Goals?

If your app helps you save money, pay off debts, or stick to a monthly budget, you’re using the right tool. But if you’ve been using the app for months without any improvement, it might be time to look for a better option.

5. Is the App Technically Reliable?

A good finance app should be stable and smooth. Check if:

- It crashes often

- It freezes

- It shows wrong numbers

- It doesn’t sync properly

A reliable app should work effortlessly.

6. Does It Feel Personal?

Your finance app should feel like it understands your lifestyle. It should adjust to your spending habits, not force you into rigid categories or confusing layouts. If the app feels “made for you,” that’s a good sign.

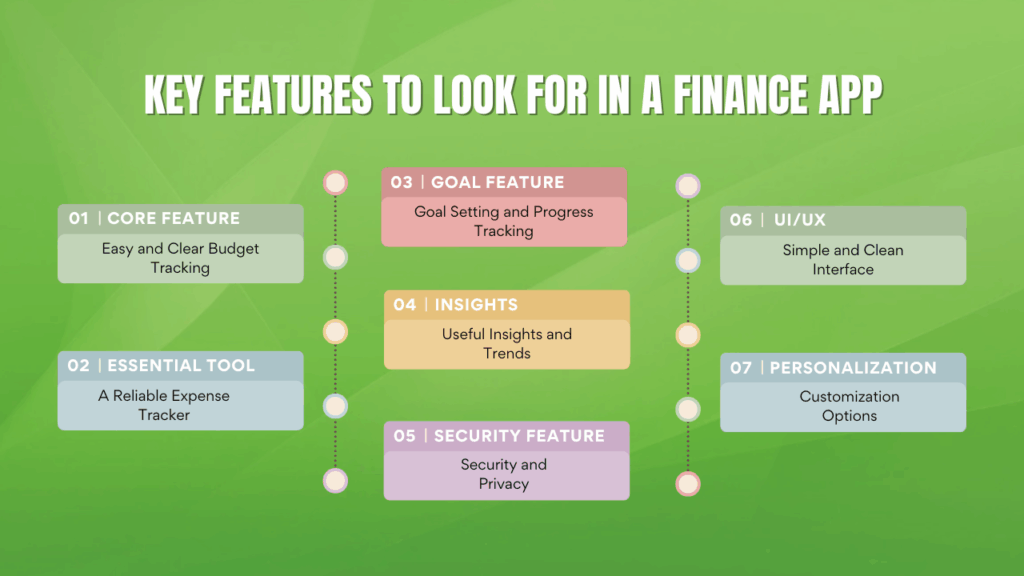

Key Features to Look for in a Finance App

If you want a finance app that genuinely makes your life easier, it should have a few key features. These features are what separate a helpful app from a useless one.

1. Easy and Clear Budget Tracking

A good finance app should make budget tracking simple. You should be able to see how much money you earn, how much you spend, and where your expenses go each month. If your app shows this in a messy or confusing way, it may not be very useful. A strong budget feature usually includes:

- Simple categories like food, bills, travel, shopping

- Clear graphs or charts

- A clean interface

- Quick expense entry

Budget tracking is one of the main reasons people use a finance app, so it needs to be smooth and easy.

2. A Reliable Expense Tracker

Your finance app should track your spending in real time. If it updates late or shows incorrect numbers, you won’t get a true picture of your money situation. A good expense tracker helps you:

- Avoid overspending

- Stay aware of your daily expenses

- Understand where your money goes

- Cut unnecessary spending

When your app tracks everything accurately, you make better financial decisions.

3. Goal Setting and Progress Tracking

A helpful finance app shouldn’t only track your expenses—it should also support your financial goals. These goals might include saving for travel, paying off loans, or building an emergency fund. A useful goal-setting feature should let you:

- Set a goal amount

- Choose a timeline

- Track your progress easily

- See how much more you need to save

Seeing your progress keeps you motivated and makes money management feel more rewarding.

4. Useful Insights and Trends

A strong finance app should also help you understand your financial behavior. It should be able to show patterns in your spending, like how much you spend on food delivery or online shopping. Good insights help you answer questions like:

- Where am I overspending?

- What category takes most of my money?

- Have my expenses increased in the last few months?

- How can I adjust my budget?

These insights help you make better choices in the future.

5. Security and Privacy

Because your finance app contains personal and financial details, it must be safe. Look for apps that offer:

- Secure login (PIN, fingerprint, or face ID)

- Data encryption

- No unnecessary permissions

- Regular security updates

Always choose an app from a trusted company. Your financial data should always stay protected.

6. A Simple and Clean Interface

Even the best features won’t matter if the app is hard to use. The app should be simple enough that you understand everything the moment you open it. A clean interface includes:

- Easy navigation

- Simple options

- Clear labels

- Readable text and visuals

If your app feels like homework, you won’t use it regularly.

7. Customization Options

Everyone manages money differently. That’s why your finance app should allow customization. Helpful customization options include:

- Custom spending categories

- Personalized budget limits

- Flexible goal settings

- Adjustable notifications

When the app fits your lifestyle, it becomes more useful and enjoyable.

Frequently Asked Questions:

1. What makes a finance app useful?

A useful finance app is easy to use, tracks your expenses clearly, helps you set goals, and keeps your data safe.

2. Can finance apps really help me save money?

Yes. A good finance app can help you manage your money better and make smarter decisions.

3. How often should I check my finance app?

A few minutes a day or a weekly review is enough for most people.

4. Are free finance apps good?

Many free apps are great, but make sure they are secure and not filled with too many ads.

5. Should I switch to another app if I’m not seeing results?

Yes. If your current app doesn’t help you improve your financial habits, consider switching.

Conclusion: Choose a Finance App That Truly Helps You

A finance app should make your money life easier not harder. It should help you track your expenses, plan your budget, understand your habits, and work toward your goals. If your current app is confusing, slow, or not guiding you in the right direction, it may be time to try something better.

If you’re looking for a clean, simple, and effective financial tool, Kenfra FinStar, one of the best finance apps in India, helps you effortlessly track expenses, set savings goals, and manage your budget. Start with its free trial to explore all the features and take a confident step toward a better financial future.

Leave a Reply